QuickBooks Workforce is a game-changer for how employees access their important payroll documents. No more waiting for paystubs and tax forms to arrive in the mail – with this digital platform, you can instantly access your financial information through a secure online portal and mobile app.

In today’s world, employees want convenience and immediate access to their employee paystubs and W-2 forms. Gone are the days of lost mail, delayed deliveries, and overflowing filing cabinets. QuickBooks Workforce solves these problems by bringing all payroll-related documents together in one easy-to-reach place.

In this guide, we’ll cover:

- How QuickBooks Workforce works smoothly with current payroll systems

- Step-by-step instructions on how to access paystubs and W-2 forms

- The security features that keep sensitive employee information safe

- The benefits of digital payroll management for both employers and employees

- The environmental benefits of going paperless with document distribution

Whether you’re an employer thinking about implementing this system or an employee using it for the first time, this article has everything you need to know to make the most of QuickBooks Workforce. If you’re looking for powerful payroll solutions for your business, check out QBO Desktop for comprehensive QuickBooks desktop services to support your workforce management needs.

Understanding QuickBooks Workforce

QuickBooks Workforce is an online platform where employees can securely access their payroll documents. It replaces the traditional method of distributing financial documents, making it easier for employees to retrieve and manage their important papers.

How QuickBooks Workforce Works

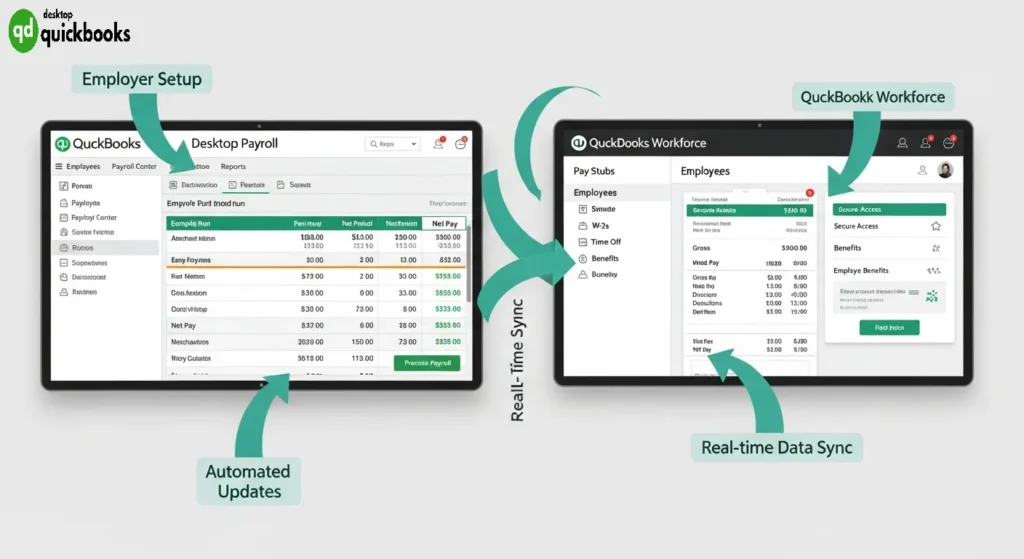

QuickBooks Workforce is part of Intuit’s payroll system and works with both QuickBooks Desktop Payroll and QuickBooks Online Payroll. When businesses use these payroll services, the platform automatically updates employee data and payroll information, allowing for immediate access to current and past documents.

Employer Role in QuickBooks Workforce

The functionality of the platform depends on employers’ involvement and setup. Employers need to invite their employees to join the platform by sending personalized invitations that enable them to create secure accounts. This system ensures that only authorized individuals can access sensitive payroll information while maintaining data integrity.

Employee Benefits of QuickBooks Workforce

The platform offers more than just document access for employees. It allows workers to handle their payroll needs independently without needing HR assistance for routine requests. Employees can verify personal information, update contact details, and view multiple years of tax documents through their individual accounts.

Integration Process Made Easy

Employers don’t need extensive technical knowledge to integrate with QuickBooks Workforce as the system automatically fills in employee information from existing payroll databases. This seamless connection guarantees accuracy while minimizing administrative tasks for businesses of all sizes.

Key Features of QuickBooks Workforce

QuickBooks Workforce offers a wide range of features that make managing payroll documents easier for both employers and employees. Here are some of the key features:

1. Digital Access to Paystubs and Payroll Documents

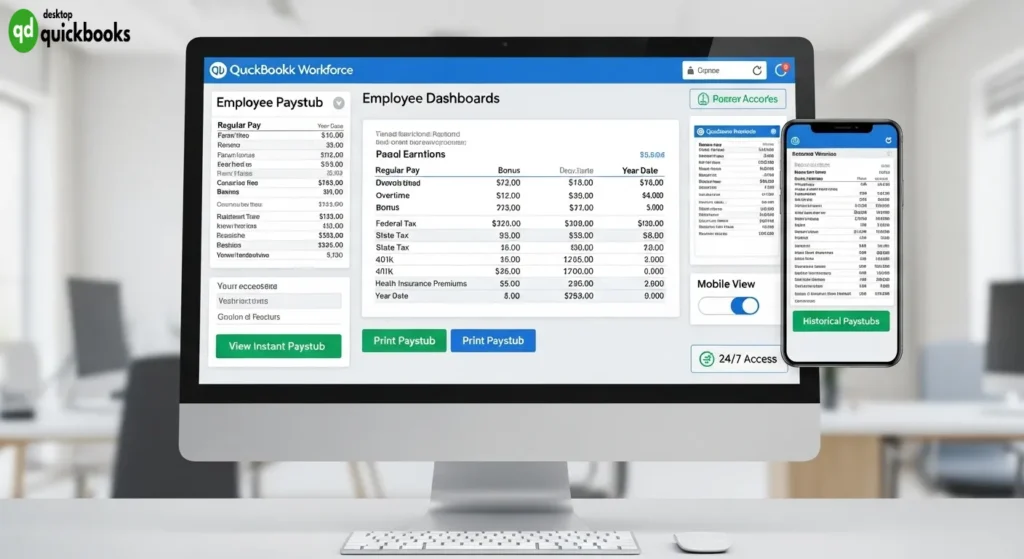

The main purpose of QuickBooks Workforce is to give employees quick access to their payroll information. Unlike traditional methods that rely on mailing documents, this platform ensures that employees can view their paystubs and other important documents in real-time.

Key capabilities include:

- Instant viewing and printing: Employees can directly view and print their paystubs from any web browser or mobile device without having to wait for physical copies.

- Complete historical access: The platform stores all current and previous payroll documents, allowing employees to access multiple years’ worth of records whenever they need them.

- 24/7 availability: Employees have the flexibility to retrieve their documents at any time, day or night, based on their convenience.

- Multiple format options: The platform caters to individual preferences by offering different formats for downloading or printing documents.

This digital approach offers significant advantages over traditional mail systems. Employees no longer have to rely on postal delivery or worry about misplaced documents. Instead, they can easily access their payroll records online whenever necessary.

2. Detailed Breakdown of Earnings and Deductions

With QuickBooks Workforce, employees can expect more than just basic pay information. Each digital paystub provides a comprehensive breakdown of earnings, deductions, and year-to-date totals.

The following details are included in every document:

- Gross pay: This represents the total amount earned before any deductions are applied.

- Tax withholdings: Employees can see exactly how much money is being withheld for taxes from each paycheck.

- Benefit deductions: Any contributions made towards employee benefits such as health insurance or retirement plans will be clearly listed.

- Net pay calculations: The final figure shown on the paystub indicates the actual amount that will be deposited into the employee’s bank account.

3. Convenient Record-Keeping for Personal Financial Management

In addition to providing immediate access to payroll information, QuickBooks Workforce also offers tools for efficient record-keeping. This feature is particularly beneficial for employees who need to maintain financial records for various purposes.

The electronic payroll documents system allows users to easily locate specific pay periods or generate reports tailored to their personal financial management needs. Whether it’s preparing tax returns or applying for loans, having organized and readily available documentation can streamline these processes significantly.

By embracing technology through platforms like QuickBooks Workforce, businesses can enhance productivity while ensuring compliance with legal requirements related to employee compensation documentation.

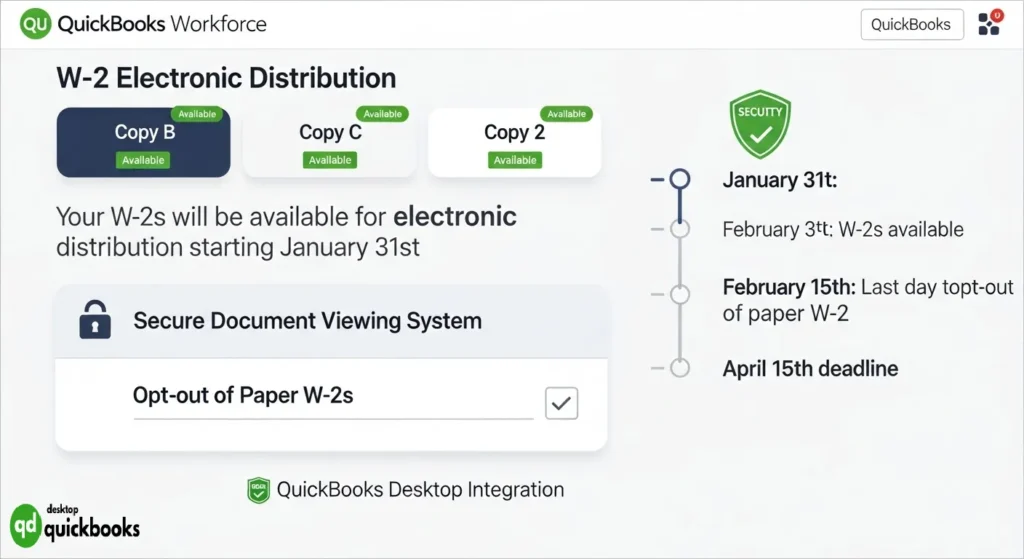

2. W-2 Forms Management

QuickBooks Workforce transforms traditional tax document management by providing employees with comprehensive W-2 form access through its secure digital platform. The system delivers electronic W-2 distribution capabilities that align with IRS requirements while maintaining the convenience of digital paystub access.

Starting January 31st annually, employees can access copies B, C, and 2 of their W-2 forms directly through the platform. This timing matches federal tax filing deadlines, ensuring employees receive their essential tax documents when needed most. The electronic payroll documents remain accessible throughout the tax season and beyond, eliminating concerns about misplaced paper forms.

The platform’s secure document viewing system includes an opt-out feature for paper W-2s, provided the employer’s payroll service supports this functionality. Employees who choose electronic delivery through QuickBooks Desktop integration reduce their environmental footprint while maintaining secure access to critical tax information.

Key W-2 management features include:

- Immediate access to all required W-2 copies for tax preparation

- Year-round availability of current and previous tax documents

- Paperless options that eliminate mail delivery delays

- Enhanced security through encrypted document storage

3. Security and Verification Measures

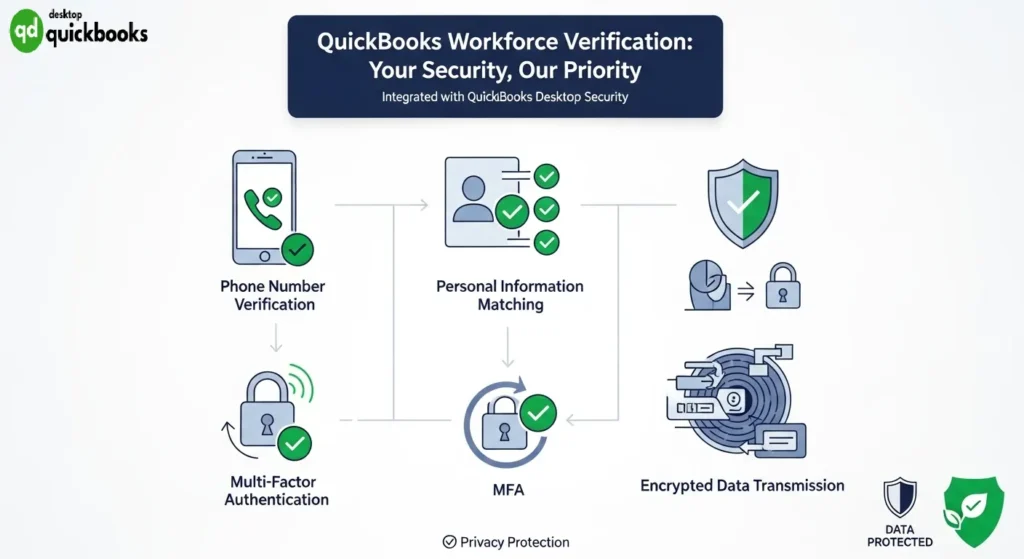

QuickBooks Workforce prioritizes account security through multiple layers of protection when employees access their electronic payroll documents. The platform implements robust personal information verification protocols that require employees to confirm their identity before gaining access to sensitive payroll data.

The secure login process includes several verification steps:

- Phone number verification – Employees must verify their registered phone number through SMS or voice confirmation

- Personal information matching – The system cross-references employee details with employer records

- Multi-factor authentication – Additional security layers protect against unauthorized access

- Encrypted data transmission – All digital paystub access occurs through secure, encrypted connections

Secure document viewing becomes essential when handling confidential payroll information that includes Social Security numbers, salary details, and tax withholdings. The platform’s security infrastructure protects against data breaches and identity theft, ensuring that only authorized employees can view their specific documents.

Employers partnering with QuickBooks Desktop providers benefit from these enhanced security measures, as the verification process reduces the risk of payroll document misdelivery while maintaining strict compliance with privacy regulations governing employee financial information.

4. Additional Employee Benefits on the Platform

QuickBooks Workforce offers more than just basic digital paystub access and electronic payroll documents. It also provides comprehensive employee self-service tools that change the way workers handle their payroll information.

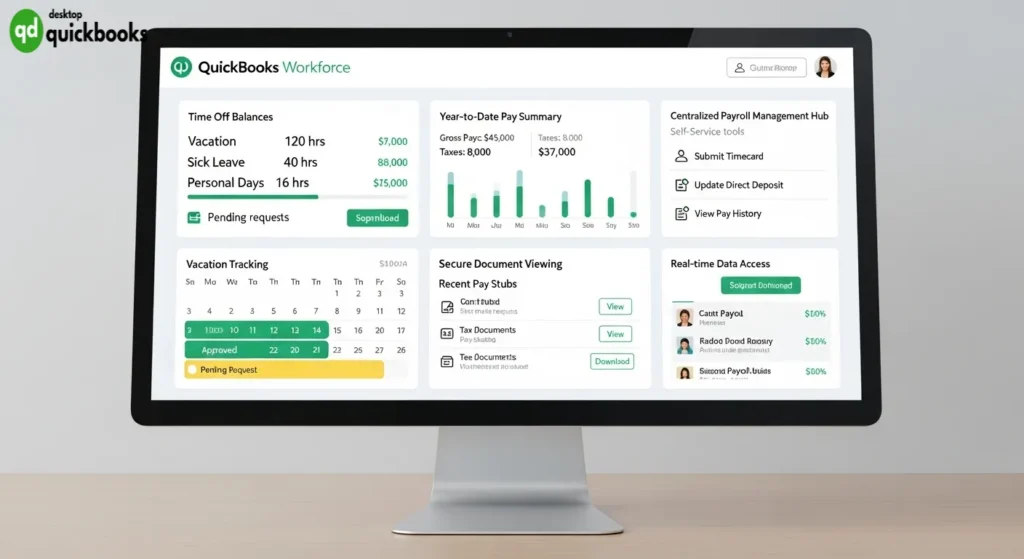

A Centralized Hub for Payroll Management

The platform acts as a central location where employees can:

- Monitor their time off balances in real-time

- Track vacation day inquiries or sick leave status updates without contacting HR departments

- Access other important payroll information

Effortless Year-to-Date Pay Tracking

With the user-friendly dashboard, tracking year-to-date pay becomes easy for employees. They can view their total earnings, deductions, and tax withholdings throughout the fiscal year at a glance.

Empowering Workers with Secure Document Viewing

The secure document viewing system gives workers the power to:

- Track vacation accruals and usage patterns

- Monitor overtime hours and compensation

- Review benefits deductions and contributions

- Access historical payroll data for financial planning purposes

Transforming Traditional Payroll Management

The QuickBooks Workforce platform revolutionizes traditional payroll management by putting crucial information directly into employees’ hands.

- Workers can independently verify their compensation details

- They can plan for tax season using accurate year-to-date figures

- Informed decisions about time off requests can be made based on current balance availability

This self-service approach not only reduces administrative burden on employers but also provides employees with instant access to critical payroll information whenever they need it.

Employer Advantages with QuickBooks Workforce

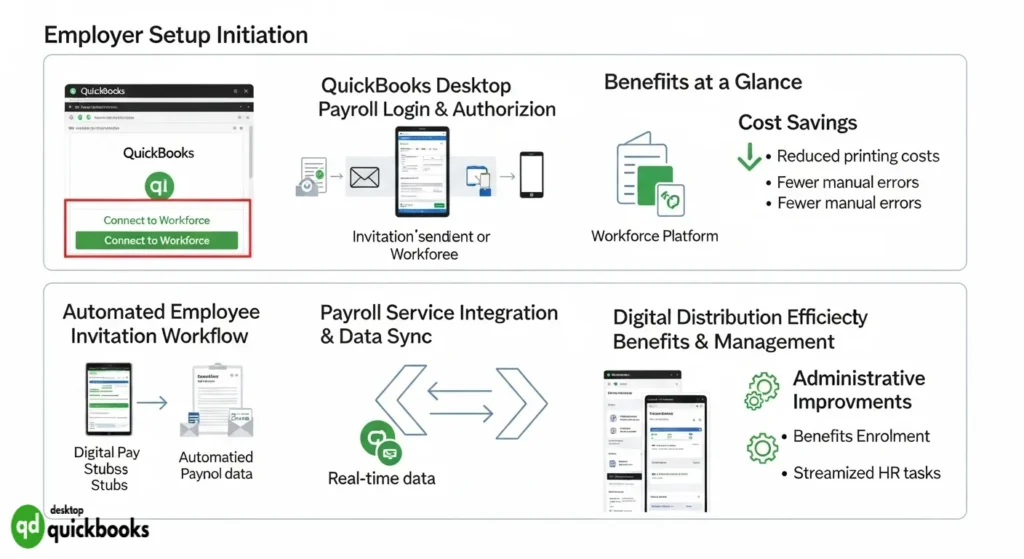

Seamless Integration with Existing Payroll Systems

The employer setup process begins when businesses using QuickBooks Desktop or QuickBooks Online Payroll decide to implement digital payroll distribution for their workforce. Employers can activate Workforce access through their existing payroll system settings, creating a seamless bridge between payroll processing and employee document access.

Automated Employee Invitations for Streamlined Onboarding

The employee invitation workflow operates through automated email invitations sent directly from the employer’s QuickBooks payroll system. Each employee receives a personalized invitation containing secure access credentials and setup instructions. This systematic approach ensures all team members receive their invitations simultaneously, eliminating the administrative burden of manual distribution.

Direct Integration with QuickBooks Payroll for Effortless Data Syncing

Payroll service integration connects directly with both QuickBooks Desktop Payroll and QuickBooks Online Payroll platforms. This native integration means employers don’t need additional software installations or complex configurations. The system automatically syncs payroll data, ensuring employees always have access to their most current information without requiring manual uploads or updates from HR departments.

Streamlining Payroll Document Distribution

Digital payroll distribution transforms traditional paper-based processes into instant, secure electronic delivery. Employers can distribute paystubs immediately after payroll processing, eliminating printing costs and postal delays. This immediate availability means employees receive their documents on payday rather than waiting for mail delivery.

The shift toward reducing paper usage delivers measurable cost savings for businesses. Companies eliminate expenses related to:

- Printing supplies and equipment maintenance

- Postage costs for mailing paystubs and tax documents

- Administrative time spent preparing physical mailings

- Storage requirements for paper document copies

Efficient document sharing through the platform improves accuracy and timeliness in document delivery. Digital distribution eliminates risks associated with lost mail, incorrect addresses, or delayed postal services. Employees can access their documents 24/7 from any device, reducing HR inquiries about missing or delayed paystubs.

The platform’s automated distribution system ensures consistent delivery timing across all employees. When payroll processing completes, documents become immediately available through the secure portal. This reliability helps employers maintain compliance with wage and hour regulations requiring timely paystub delivery while reducing administrative overhead associated with traditional distribution methods.

How Employees Can Access Their Documents on QuickBooks Workforce

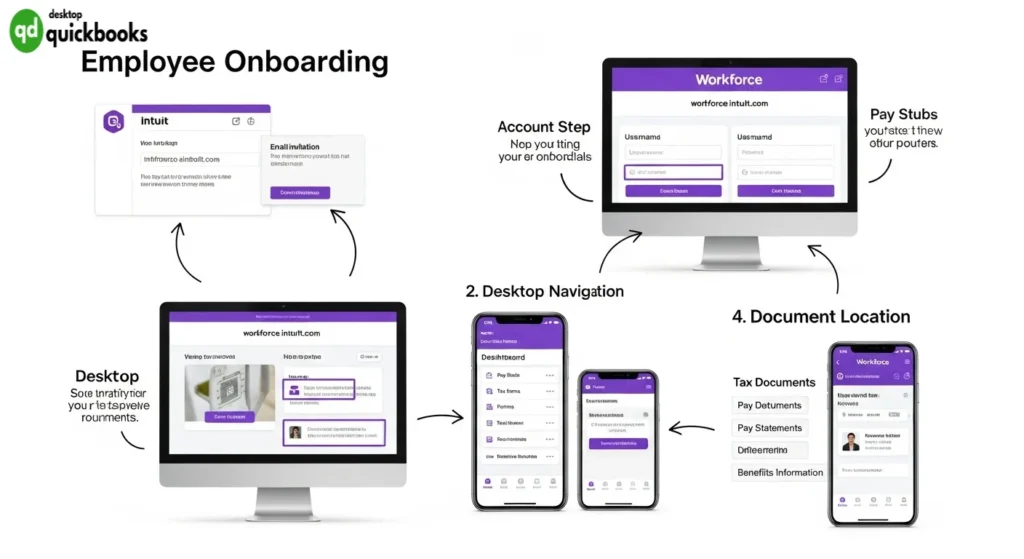

Understanding the Account Registration Process

The account registration process begins when employers send invitations to their workforce through the QuickBooks payroll system. Employees receive these invitations via email, containing a secure link to begin their employee onboarding to Workforce. The invitation includes specific instructions and a unique access code that ensures only authorized personnel can create accounts.

Setting Up Your Login Credentials

Setting up login credentials requires employees to visit workforce.intuit.com or download the mobile application from their device’s app store. During registration, users must provide:

- Valid email address (preferably the one used for employment records)

- Strong password meeting security requirements

- Personal verification information matching employer records

- Phone number for two-factor authentication when required

The quickbooks workforce platform automatically verifies employee information against employer-provided data to maintain security protocols. This verification step prevents unauthorized access and protects sensitive payroll information from potential breaches.

Navigating the Platform to Find Paystubs and W-2s

The user interface overview presents a clean, intuitive dashboard upon successful login. The main navigation menu appears prominently at the top of the screen, with clearly labeled sections for different document types and account management features.

Platform navigation tips for efficient document access include:

- Documents Menu Location: Click the “Documents” tab in the primary navigation bar

- Document Categories: Use dropdown filters to sort by document type (paystubs, W-2s, 1099s)

- Date Range Selection: Apply date filters to locate specific pay periods or tax years

- Search Functionality: Enter keywords or dates in the search bar for quick document retrieval

Locating payroll documents online becomes straightforward once users understand the organizational structure. Paystubs appear chronologically with the most recent entries displayed first. Each document shows essential details like pay period dates, gross pay amounts, and issue dates before opening the full document.

The mobile app mirrors the website’s functionality while optimizing the interface for smaller screens. Touch-friendly buttons and swipe gestures enhance the mobile experience, allowing employees to access their documents anywhere with internet connectivity.

Document viewing options include both on-screen display and downloadable PDF formats. The platform automatically saves viewing preferences, streamlining future access sessions. Print functionality works

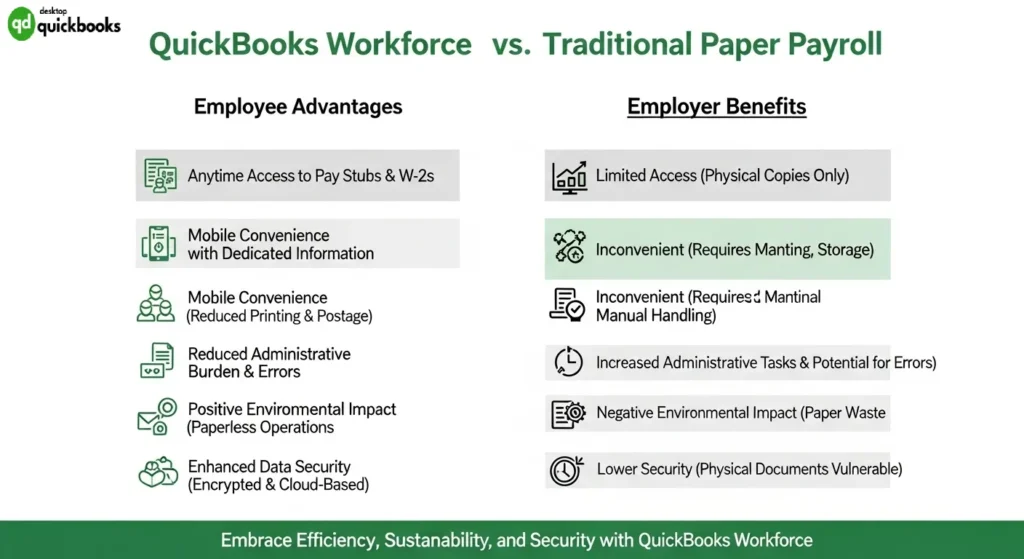

Advantages of Using QuickBooks Workforce for Employees and Employers

QuickBooks Workforce delivers significant benefits that extend beyond simple document access, creating value for both employees and employers through modern paperless payroll solutions.

Employee Benefits:

- Anytime access payroll info from any location with internet connectivity

- Mobile app convenience enabling document retrieval during commutes, breaks, or personal time

- Remote document retrieval eliminates dependency on physical mail delivery schedules

- Instant availability of historical payroll records for loan applications, apartment rentals, or tax preparation

- Reduced risk of losing important documents through secure digital storage

Employer Advantages:

- Streamlined payroll administration with automated document distribution

- Cost savings from eliminating printing, postage, and mailing expenses

- Enhanced employee satisfaction through self-service capabilities

- Reduced administrative burden handling document reprint requests

Environmental Impact Through Paper Reduction

The platform’s eco-friendly document handling approach creates measurable sustainability benefits for organizations committed to environmental responsibility. By choosing electronic delivery over traditional paper methods, companies significantly reduce their carbon footprint while supporting green business practices.

Employees opting out of paper W-2s and paystubs contribute to substantial paper waste reduction across thousands of businesses using QuickBooks Desktop payroll services. This quickbook workforce feature aligns with corporate sustainability goals while maintaining full compliance with payroll documentation requirements.

The digital-first approach represents a win-win solution: employees gain enhanced accessibility while employers demonstrate environmental stewardship through reduced paper consumption.

Enhanced Security Compared to Traditional Methods

QuickBooks Workforce transforms payroll security through encrypted online portals that eliminate vulnerabilities associated with physical documents. Traditional paper paystubs and W-2 forms face constant risks of theft, loss, or damage during mail delivery, leaving sensitive financial information exposed.

The platform’s secure digital storage system provides controlled access to sensitive data through multi-layer verification processes. Employees must authenticate their identity before accessing payroll documents, creating a protected environment that surpasses physical security measures.

Paperless payroll solutions through QuickBooks Workforce offer anytime access payroll info capabilities while reducing risk of lost documents. The mobile app convenience enables remote document retrieval from any location, ensuring employees maintain constant access to their financial records without compromising security protocols.

Digital authentication systems prevent unauthorized access more effectively than physical mailboxes or filing cabinets, making QuickBooks Desktop integration with Workforce a superior security solution for modern payroll management.

FAQs (Frequently Asked Questions)

What is QuickBooks Workforce and how does it benefit employees?

QuickBooks Workforce is a digital payroll document platform that allows employees to securely access their paystubs, W-2 forms, and other payroll documents online. It offers convenient anytime access through its website or mobile app, enabling employees to view and print current and past payroll information without relying on physical mail.

How do employers set up QuickBooks Workforce for their employees?

Employers integrate QuickBooks Workforce with QuickBooks Desktop Payroll or Online Payroll services and invite employees to join the platform. This setup streamlines payroll document distribution by reducing paper usage and ensures timely, accurate delivery of paystubs and W-2 forms electronically.

What security measures does QuickBooks Workforce implement to protect payroll information?

QuickBooks Workforce employs secure login processes including verification of phone numbers or personal information before granting access to sensitive data. The platform uses encrypted online portals to safeguard personal and payroll information, reducing risks associated with lost or stolen physical documents.

Can employees access their W-2 forms through QuickBooks Workforce?

Yes, starting January 31 annually, employees can access copies B, C, and 2 of their W-2 forms digitally through QuickBooks Workforce. Employees may also opt out of receiving paper W-2s if supported by their employer’s payroll service, promoting paperless tax document management.

What additional employee benefits are available on the QuickBooks Workforce platform?

Beyond paystub and W-2 access, QuickBooks Workforce provides tools for viewing time off balances, tracking year-to-date earnings, and managing payroll information via self-service features. These functionalities empower employees with greater control over their payroll data.

How does using QuickBooks Workforce contribute to environmental sustainability?

By offering digital paystub access and electronic distribution of payroll documents like W-2s, QuickBooks Workforce significantly reduces reliance on paper mailings. This paperless approach supports eco-friendly document handling practices and helps decrease overall paper waste in payroll management.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.