QuickBooks checks are an essential tool for managing business finances. They work seamlessly with QuickBooks software to make payment processing and record-keeping easier. These specialized checks allow companies to have precise control over their financial transactions while minimizing manual data entry errors.

The advantages of using QuickBooks-compatible checks include:

- Direct printing capabilities from your QuickBooks software

- Automated record synchronization between physical checks and digital transactions

- Enhanced security features to protect against fraud

- Professional customization options for brand consistency

QuickBooks checks can be used for various business purposes, such as managing payroll and handling accounts payable. The built-in compatibility with QuickBooks software creates a unified system for tracking expenses, maintaining audit trails, and generating financial reports.

This comprehensive guide explores the essential aspects of QuickBooks checks, including:

- Detailed explanations of check formats and compatibility requirements

- Time-saving features for efficient payment processing

- Customization options for business branding

- Security measures and fraud prevention

- Practical tips for check printing and management

- Digital record integration strategies

Whether you’re a small business owner or managing a large organization’s finances, understanding how to leverage QuickBooks checks can significantly improve your payment processes and financial record accuracy.

Understanding QuickBooks Checks

QuickBooks checks are specialized payment instruments designed to work seamlessly with Intuit’s QuickBooks accounting software. These checks serve as physical payment tools that integrate directly with your QuickBooks financial data, creating an automatic record of each transaction while maintaining the traditional function of paper checks.

Core Components of QuickBooks Checks:

- Pre-printed MICR line containing your bank’s routing number

- Custom check number sequence

- Built-in security features

- Check stub sections for detailed payment records

- QuickBooks-specific formatting for accurate data sync

The integration between QuickBooks checks and the software creates a synchronized system where every printed check automatically updates your accounting records. This automated process eliminates manual data entry, reducing errors and saving valuable time.

Available Check Formats:

- Wallet Checks: Single check per page, ideal for personal payments, includes detailed payment stub

- Voucher Checks: Three-part format, built-in payment record, perfect for vendor payments

- Three-Per-Page Checks: Maximum efficiency, cost-effective option, suitable for high-volume payments

Using QuickBooks-compatible checks ensures your payment information aligns perfectly with the software’s printing specifications. Non-compatible checks can lead to misaligned printing, incorrect data synchronization, and potential banking errors.

The check format you choose impacts your payment workflow and record-keeping capabilities. Voucher checks provide detailed payment records directly on the check stub, while three-per-page formats maximize efficiency for businesses processing multiple payments.

These specialized checks include built-in features for accurate record-keeping:

- Payment date tracking

- Vendor information storage

- Account categorization

- Payment amount verification

- Automatic balance updates

QuickBooks checks create a bridge between digital accounting and physical payment methods, maintaining the security and familiarity of paper checks while leveraging the power of modern accounting software.

Key Features and Benefits of Using QuickBooks Checks

1. Versatile Printer Compatibility

QuickBooks checks shine with their versatile printer compatibility, accommodating both laser and inkjet printers. This dual compatibility eliminates the need for specialized printing equipment, allowing you to use your existing office printer for check production.

Benefits of Printer Compatibility:

- Laser printers deliver crisp, professional-looking checks with precise alignment

- Inkjet printers offer cost-effective printing for smaller check volumes

- Auto-alignment features prevent costly printing errors

- Built-in calibration tools ensure accurate check positioning

- Multiple paper handling options support different check styles

The software’s printing capabilities extend beyond basic functionality, offering advanced features like:

- Print preview options to catch errors before printing

- Batch printing capabilities

- Custom margin adjustments

- Multiple check formats on a single page

- Automatic MICR line positioning

2. Extensive Check Design Variety

QuickBooks checks come in an extensive range of designs to match your business identity:

Standard Designs:

- Classic blue security background

- Traditional green marble pattern

- Professional gray gradient

- Minimalist white background

Premium Options:

- Custom color schemes matching brand palettes

- Industry-specific designs for medical, legal, or retail businesses

- Seasonal themes for holiday-specific transactions

- Personalized layouts with multiple stub options

The design flexibility carries through to practical features:

- Detachable check stubs for easy record-keeping

- Built-in security features like microprinting

- Customizable fields for specific business needs

- Voucher options for detailed payment tracking

Each check design undergoes rigorous testing to ensure compatibility with banking systems and QuickBooks software, providing you with reliable, professional-grade checks that work seamlessly with your accounting processes.

Time-Saving Features in Payroll and Accounts Payable Management with QuickBooks Checks

QuickBooks checks are changing the game for payroll and accounts payable management with their ability to print multiple checks at once. You can now print up to three checks on a single page, which means you’ll spend much less time getting checks ready by hand.

How Multi-Check Printing Makes Payments Easier

The multi-check printing feature makes your payment processes smoother:

- Batch Processing: Print multiple checks at the same time for different vendors or employees

- Automated Data Entry: QuickBooks automatically fills in payment details, reducing manual input errors

- Smart Scheduling: Schedule recurring payments and print checks in advance

- Stub Management: Generate detailed payment stubs with customizable fields for thorough record-keeping

Automatic Tax Calculations and Recurring Payments

The system takes care of calculating tax withholdings and deductions on its own, making sure payroll processing is accurate. For regular vendors, you can set up recurring payment schedules so you won’t have to create individual checks manually for each payment cycle.

Saving Time and Money

Here’s how the multi-check printing feature helps you save time and money:

- Reduced paper handling and storage costs

- Decreased manual data entry time

- Lower risk of payment delays

- Minimized printing supplies waste

- Enhanced productivity through automated processes

Keeping Track of Payments with QuickBooks Integration

The multi-check printing feature works perfectly with QuickBooks’ reporting functions. This means you can easily track payment histories and keep detailed financial records. With this integration, you’ll have a complete system for managing your business’s cash flow while also keeping accurate documentation for tax purposes.

Customizing Your Business Checks: Styles, Colors, and Logos

Your business checks are an important part of your brand identity. With QuickBooks-compatible checks, you have the flexibility to customize them extensively, making them professional and in line with your company’s image.

Available Check Styles

- Standard business checks with detachable vouchers

- Wallet-style checks for compact storage

- Three-per-page formats for efficient processing

- Premium laser checks with security features

- Manual checks with carbon copies

Color Selection Guidelines

- Choose colors that match your brand palette

- Select contrasting background shades for improved readability

- Consider darker hues for a professional appearance

- Opt for lighter tones to highlight security features

- Utilize color-coding for different bank accounts

Logo Integration Best Practices

- Submit high-resolution logo files (300 DPI minimum)

- Position your logo in the designated upper-left corner

- Maintain proper scaling to ensure clarity

- Use vector formats when possible

- Consider black and white versions for better printing

Design Elements to Consider

- Custom background patterns

- Company address and contact information

- Unique identifying numbers

- Bank information positioning

- Special security features integration

The customization process through QuickBooks allows you to preview your check design before placing an order. This feature helps ensure your checks meet both aesthetic and functional requirements. Many suppliers offer design assistance services to help optimize your check layout while maintaining compliance with banking regulations.

Your check design can incorporate multiple security features without compromising your brand aesthetics. Advanced printing techniques allow for watermarks, microprinting, and other security elements to blend seamlessly with your chosen design elements.

Remember to test print your customized check design on plain paper before ordering to verify proper alignment and readability. This practice helps avoid costly reprints and ensures your checks maintain a professional appearance while functioning correctly within your QuickBooks system.

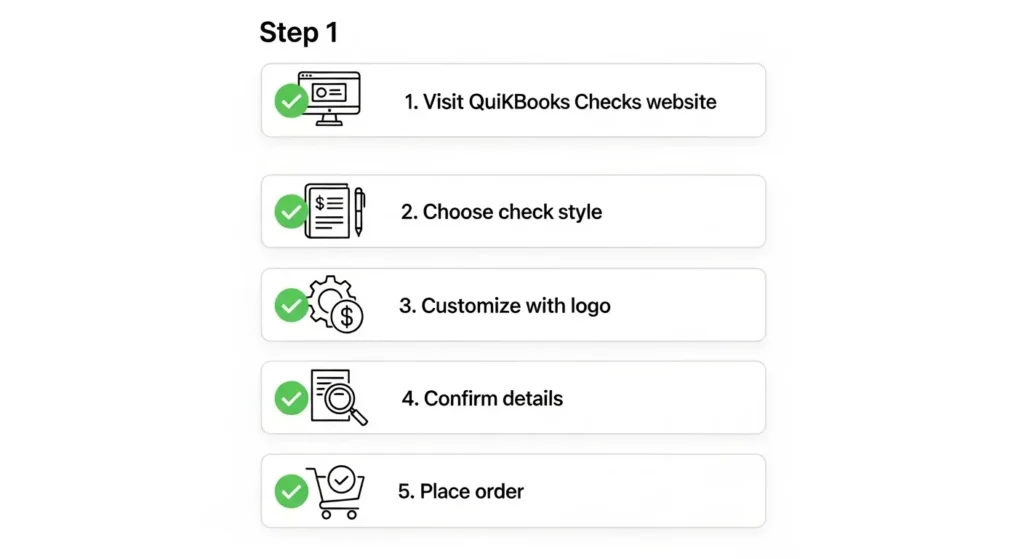

Ordering Process: Getting Your Hands on Reliable Quickbooks Checks Online

Ordering QuickBooks-compatible checks online requires attention to detail and careful selection of vendors. Here’s a step-by-step guide to secure your business checks:

1. Identify Your Check Requirements

- Check format (wallet, standard, or voucher)

- Quantity needed

- Desired security features

- Starting check number

2. Choose a Reputable Vendor

- Look for vendors with QuickBooks certification

- Check customer reviews and ratings

- Verify secure payment processing

- Compare pricing and shipping options

3. Place Your Order

- Select your preferred check style

- Enter your business information

- Upload your company logo (if applicable)

- Specify bank account details

- Choose shipping method

Essential Information for Ordering:

- Business legal name

- Address

- Phone number

- Bank routing number

- Account number

- Bank fractional number

- Bank MICR line information

Tips for a Smooth Ordering Process:

- Double-check all entered information

- Keep a copy of your order confirmation

- Consider ordering extra checks to avoid rush orders

- Save your check specifications for future orders

Many vendors offer specialized customer support to guide you through the ordering process. Some providers also feature design preview tools, allowing you to visualize your checks before finalizing the purchase. Delivery times typically range from 2-10 business days, depending on your chosen shipping method and customization requirements.

Ensuring Security and Fraud Prevention Measures with Your Business Cheques Printed through The Software

QuickBooks-compatible business checks come with advanced security features to protect your financial transactions. These built-in safeguards help prevent unauthorized changes and counterfeiting attempts.

Essential Security Elements:

- Microprinting – Tiny text appears as a solid line to the naked eye but becomes readable under magnification

- Chemical Protection – Special paper treatments react visibly to common check-washing chemicals

- Security Watermarks – Heat-sensitive marks fade when rubbed, indicating authenticity

- UV Fibers – Embedded threads glow under ultraviolet light

- Void Pantograph – Hidden “VOID” text appears when checks are photocopied

The checks have unique serial numbers and magnetic ink character recognition (MICR) encoding. This MICR line contains your bank routing and account numbers printed with special magnetic ink that banking systems can read accurately.

Additional Protection Measures:

- Foil holograms that change color when viewed from different angles

- Security screens with complex patterns resistant to digital scanning

- Warning bands highlighting security features for quick verification

- Thermochromic ink that changes color with temperature variations

QuickBooks software enhances these physical security features by keeping detailed digital records of all check transactions. The system tracks check numbers, amounts, and payee information, creating an audit trail that helps identify any unauthorized or suspicious activity.

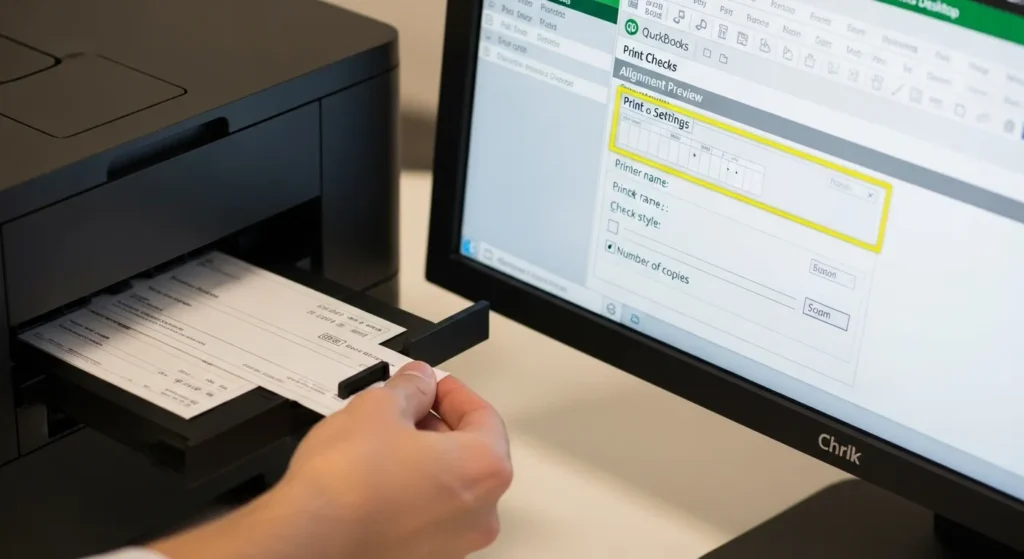

Practical Guide: Printing Cheques Effectively Using The Software’s Functionality Built-in To It

Setting up your printer and QuickBooks software correctly ensures accurate check printing every time. Here’s your step-by-step guide to print checks seamlessly:

1. Initial Printer Setup

- Place check paper in your printer’s designated tray

- Adjust paper guides to prevent misalignment

- Select the correct paper size in printer settings

- Run a test print on blank paper to verify alignment

2. QuickBooks Configuration

- Navigate to File > Printer Setup

- Select “Check/Paycheck” in the Form Name dropdown

- Choose your printer from the list

- Set paper orientation to “Portrait”

3. Check Style Settings

- Click Lists > Chart of Accounts

- Select the appropriate bank account

- Choose “Check Preferences”

- Select your check style (voucher, standard, or wallet)

- Verify check number sequence

4. Print Settings Verification

- Click “Print Setup” in the check writing window

- Select “Partial page” or “Page-oriented” printing

- Specify starting check number

- Choose number of copies needed

- Set date format preferences

5. Alignment Adjustments

- Print a sample check on blank paper

- Hold it up to light against a real check

- Adjust horizontal and vertical alignment

- Use the fine-tune settings in 0.1-inch increments

- Test print until alignment matches perfectly

6. Batch Printing Process

- Select multiple checks for printing

- Review all details before printing

- Click “Print” when ready

- Store printed checks securely

Remember to maintain proper check stock levels and regularly clean your printer heads for optimal print quality. QuickBooks automatically records each printed check in your accounting records, creating a seamless integration between physical and digital transactions.

For high-volume check printing, consider using the batch printing feature to maximize efficiency. This feature allows you to print multiple checks simultaneously while maintaining accurate records and proper check number sequences.

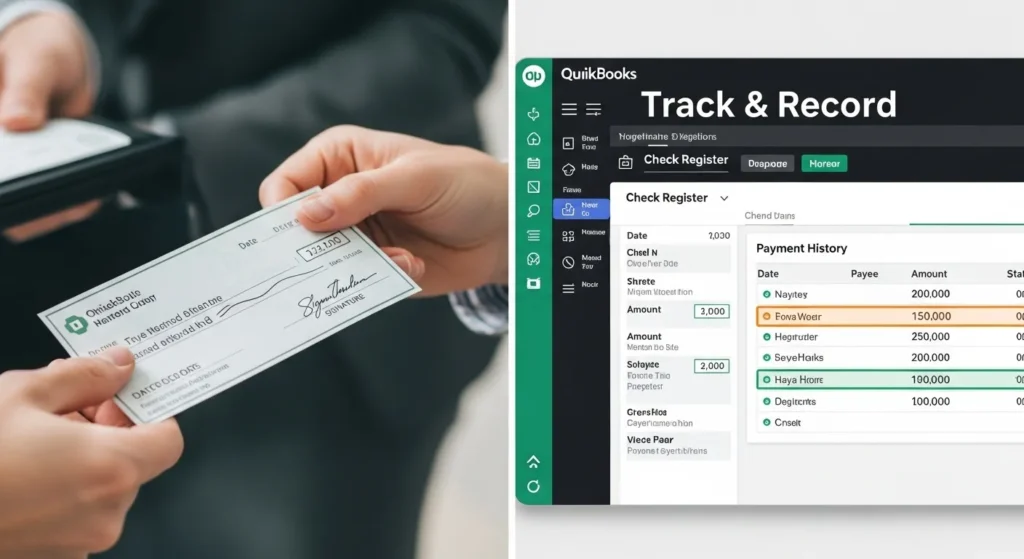

Managing Payments Efficiently With The Help Of Both Physical Copies And Digital Records

QuickBooks checks create a dual-record system that strengthens your payment management strategy. Here’s how to maximize the benefits of both physical and digital records:

Digital Record Management

- Set up automatic payment reconciliation to match physical checks with digital transactions

- Create custom payment categories for easy sorting and reporting

- Use QuickBooks’ search function to locate specific transactions by check number, amount, or payee

- Enable real-time synchronization between your bank accounts and QuickBooks records

Physical Check Organization

- Implement a numerical filing system for printed checks

- Store voided checks separately with clear markings

- Maintain a check register with detailed notes

- Create backup copies of important payment documents

Best Practices for Dual-System Management

- Scan physical checks immediately after receipt

- Attach digital copies to corresponding QuickBooks transactions

- Document any discrepancies between physical and digital records

- Perform weekly reconciliation between both systems

Smart Payment Tracking

- Use QuickBooks’ built-in reminder system for recurring payments

- Set up alerts for low check stock

- Create payment reports combining both digital and physical transaction data

- Monitor payment patterns through QuickBooks analytics

Record Retention

- Store physical checks in a secure, organized filing system

- Back up digital records daily

- Keep payment documentation for the legally required period

- Maintain an audit trail linking physical checks to digital entries

These practices help create a robust payment management system that leverages both physical and digital components of QuickBooks checks, ensuring accurate financial tracking and simplified audit processes.

Conclusion

QuickBooks checks are a powerful combination of traditional payment methods and modern digital efficiency. They streamline payment processing, enhance security measures, and maintain accurate records, making them an essential tool for growing businesses.

The benefits of using QuickBooks checks are clear:

- Automated Payment Processing: Print multiple checks at once, reducing manual data entry and processing time

- Enhanced Security Features: Built-in fraud prevention measures protect your financial transactions

- Professional Presentation: Customizable designs reflect your brand identity

- Seamless Integration: Perfect synchronization between physical checks and digital records

- Cost-Effective Solution: Reduced errors and improved efficiency lead to significant cost savings

Your business deserves a payment system that matches its ambitions. QuickBooks checks deliver this by combining the reliability of traditional paper checks with the convenience of digital management. The system’s comprehensive approach to payment processing empowers you to focus on growing your business while maintaining precise control over your financial operations.

Make the switch to QuickBooks checks today – your business’s financial management will thank you for it.

FAQs (Frequently Asked Questions)

What are QuickBooks checks and why are they important for business financial processes?

QuickBooks checks are specially designed business checks compatible with QuickBooks software, facilitating seamless payment processing and accurate record-keeping. They play a crucial role in streamlining financial transactions within businesses by ensuring smooth integration with accounting systems.

How do I choose the right QuickBooks-compatible business checks for my company?

Selecting the right QuickBooks-compatible business checks involves considering printer compatibility (laser or inkjet), check format, and available designs that align with your business preferences and branding. Using compatible checks ensures hassle-free printing and accurate transaction recording within QuickBooks software.

What time-saving features do QuickBooks checks offer in payroll and accounts payable management?

QuickBooks checks include a multi-check printing feature that allows businesses to print multiple checks simultaneously, significantly reducing manual preparation time and associated costs in payroll and accounts payable processes. This feature enhances operational efficiency and accuracy.

Can I customize my QuickBooks business checks with styles, colors, or logos?

Yes, QuickBooks-compatible business checks offer customizable options including various styles, colors, and the ability to add your company logo. Customizing your checks helps maintain a professional appearance while reinforcing your brand identity on all payment documents.

What security measures are incorporated into QuickBooks-compatible business checks to prevent fraud?

QuickBooks-compatible business checks often include security features such as watermarking techniques, special inks, and other anti-fraud elements implemented by manufacturers. These measures help protect businesses from check fraud and ensure secure financial transactions when using the software.

How can I effectively print QuickBooks checks using the software’s built-in functionality?

To print QuickBooks checks effectively, set up your printer correctly (ensuring compatibility with laser or inkjet printers), configure necessary settings within the software, and follow step-by-step printing instructions provided by QuickBooks. Proper setup guarantees accurate check printing without errors or delays.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.