Intuit QuickBooks is a powerful tool for managing business finances, making complex accounting tasks simple and efficient. It’s an all-in-one platform that serves as a digital hub for businesses of all sizes, from small startups to large corporations.

QuickBooks excels in these essential areas:

- Financial Tracking: Monitor your income, expenses, and cash flow in real-time.

- Automated Bookkeeping: Let our smart system categorize transactions and reconcile accounts automatically.

- Payroll Management: Process employee payments and calculate taxes effortlessly.

- Payment Processing: Accept payments through various methods including credit cards, ACH transfers, and digital wallets.

- Business Insights: Generate customizable reports and analytics to make informed decisions.

Small business owners, freelancers, and accounting professionals can all benefit from Intuit QuickBooks’ user-friendly interface and powerful features. The platform is adaptable to different industries such as:

- Retail

- Services

- Manufacturing

- Professional services

- E-commerce

With Intuit QuickBooks, there’s no need for manual bookkeeping anymore. Our AI-powered automation takes care of that for you. Plus, with our cloud-based system, you can securely access your financial data from anywhere at any time. This allows for real-time collaboration between team members, accountants, and financial advisors.

What sets QuickBooks apart is its combination of advanced tools and easy-to-use design. We believe that sophisticated accounting should be accessible to everyone, regardless of their financial knowledge or experience level.

Key Features of Intuit QuickBooks

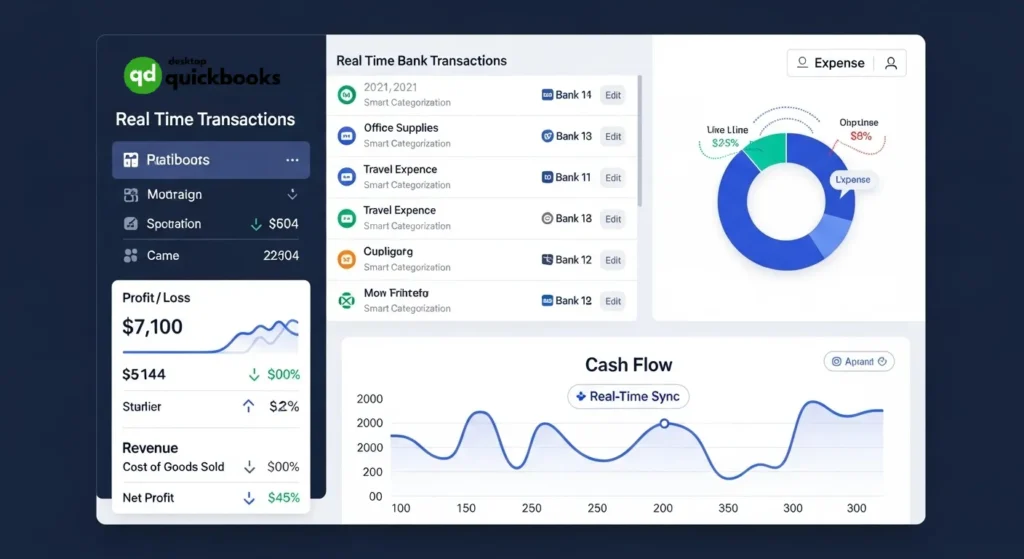

Real-Time Financial Tracking

QuickBooks makes financial tracking easy with its user-friendly dashboard. Business owners can quickly see:

- Bank Transactions: Automatic syncing with bank accounts for real-time balance updates

- Expense Categories: Smart categorization of expenses for organized record-keeping

- Cash Flow Status: Visual representations of money movement with customizable graphs

- Financial Reports: On-demand generation of profit and loss statements, balance sheets, and cash flow reports

Advanced Payroll Management

The platform’s payroll system handles complex calculations and compliance requirements:

- Automated tax calculations for federal, state, and local taxes

- Direct deposit processing with flexible scheduling options

- Employee portal access for W-2s and pay stubs

- Workers’ compensation tracking and payments

- Built-in time tracking integration for hourly employees

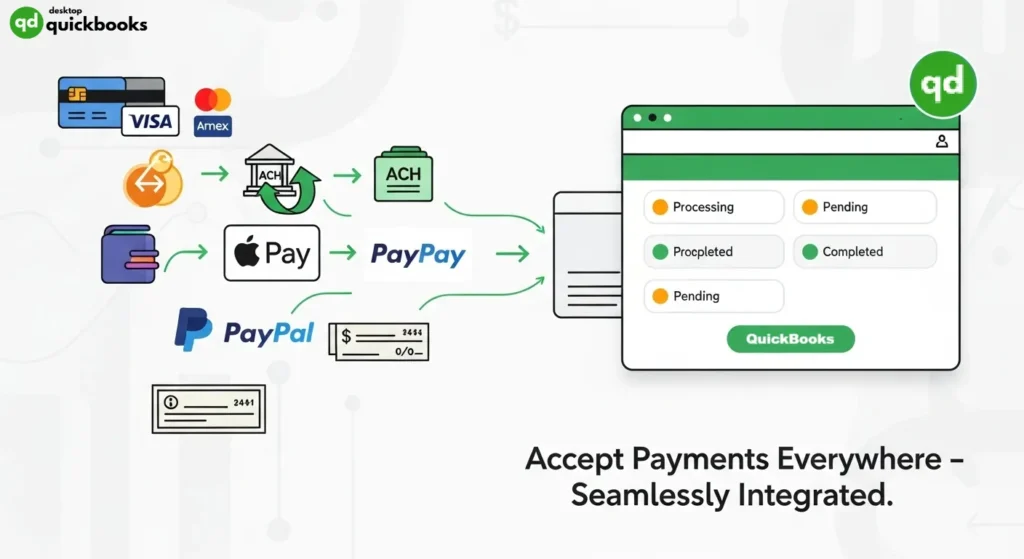

Multi-Channel Payment Processing

QuickBooks streamlines revenue collection through diverse payment options:

Digital Payments

- Credit and debit cards

- ACH bank transfers

- Digital wallets (Apple Pay, Google Pay)

- PayPal and Venmo integration

Traditional Methods

- Check scanning and processing

- Cash transaction recording

- Wire transfer tracking

Invoice Management System

The platform’s invoicing capabilities include:

- Customizable invoice templates with business branding

- Recurring invoice automation for regular clients

- Payment reminders and late fee calculations

- Multi-currency support for international transactions

- Mobile invoice creation and sending

Cash Flow Management Tools

QuickBooks provides essential tools for maintaining healthy cash flow:

- Accounts Receivable: Track outstanding payments and aging reports

- Accounts Payable: Schedule vendor payments and manage due dates

- Cash Flow Forecasting: Predict future cash positions based on historical data

- Working Capital Insights: Analyze cash flow patterns and identify potential shortfalls

These integrated features work together to create a robust financial management system that adapts to various business needs and scales with company growth.

Smart Decision-Making with QuickBooks

QuickBooks transforms raw financial data into actionable insights through its comprehensive reporting system. Business owners can access real-time profit and loss statements that break down:

- Revenue streams by product or service

- Operating expenses by category

- Gross profit margins

- Net income trends

The platform’s expense breakdown reports provide granular visibility into spending patterns, helping identify:

- High-cost areas requiring optimization

- Seasonal spending fluctuations

- Vendor-specific expenditures

- Tax-deductible expenses

Strategic Financial Planning with Intuit QuickBooks

Intuit QuickBooks’ budgeting tools enable strategic financial planning through:

Custom Budget Creation

- Set spending limits by department

- Allocate resources based on historical data

- Create multiple budget scenarios

Variance Analysis

- Compare actual vs. projected figures

- Track budget adherence in real-time

- Identify unexpected cost increases

Cash Flow Forecasting

- Project future cash positions

- Plan for seasonal fluctuations

- Anticipate potential shortfalls

Data-Driven Insights for Business Growth

The platform’s Smart Insights feature automatically flags potential issues and opportunities:

“Your utility costs increased 25% compared to last quarter”

“Revenue from Product Line A shows 40% growth potential based on current trends”

These data-driven insights enable businesses to:

- Adjust pricing strategies

- Optimize inventory levels

- Identify profitable customer segments

- Make informed hiring decisions

- Plan strategic investments

Monitoring Key Performance Indicators (KPIs)

QuickBooks’ customizable dashboard allows users to monitor key performance indicators (KPIs) at a glance, ensuring critical financial metrics remain visible and actionable throughout the decision-making process.

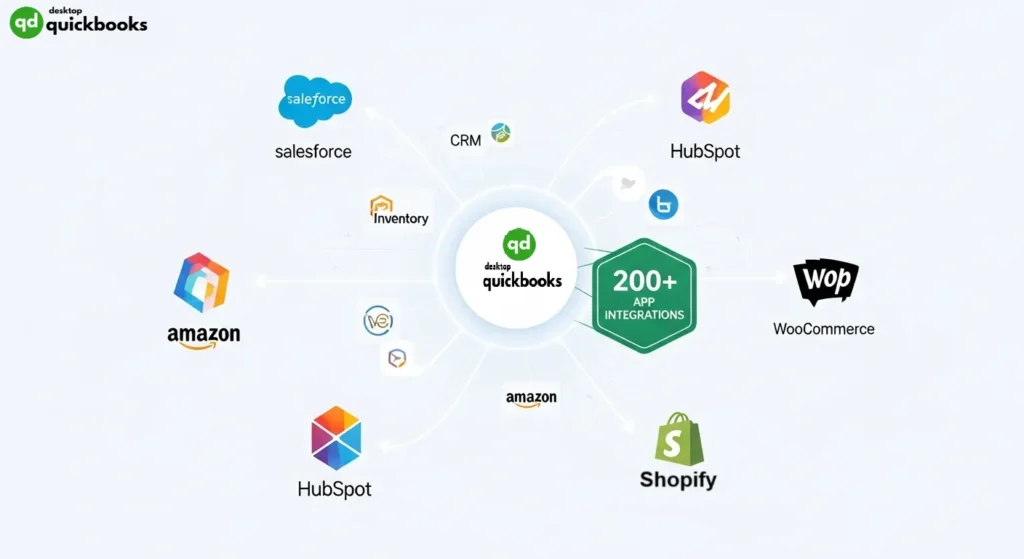

Integration and Third-Party Apps

QuickBooks’ power extends beyond its native capabilities through seamless integration with essential business tools. The platform connects with popular CRM systems like Salesforce and HubSpot, creating a unified view of customer interactions and financial transactions. This integration enables businesses to:

- Track sales opportunities and their financial impact

- Monitor customer payment histories

- Analyze revenue patterns by customer segments

- Sync contact information across platforms

E-commerce integration stands as a cornerstone of QuickBooks’ connectivity features. The platform directly links with:

Popular Online Marketplaces

- Shopify

- Amazon

- WooCommerce

- BigCommerce

These integrations automatically sync inventory levels, sales data, and payment information, eliminating manual data entry and reducing errors.

The QuickBooks App Store hosts hundreds of third-party applications that enhance financial management capabilities:

Inventory Management

- Real-time stock level tracking

- Automated reorder points

- Multi-location inventory control

- Barcode scanning functionality

Project Management Tools

- Time tracking per project

- Budget monitoring

- Resource allocation

- Milestone billing automation

Document Management

- Digital receipt capture

- Expense categorization

- Cloud storage integration

- Audit trail maintenance

Custom API access allows developers to build specialized integrations tailored to unique business needs. This flexibility enables companies to create personalized workflows that connect Intuit QuickBooks with proprietary systems or industry-specific software.

The platform’s open architecture supports data synchronization across multiple channels, ensuring consistency in financial reporting and business operations. Real-time data flows between integrated systems provide accurate, up-to-date information for decision-making across all business functions.

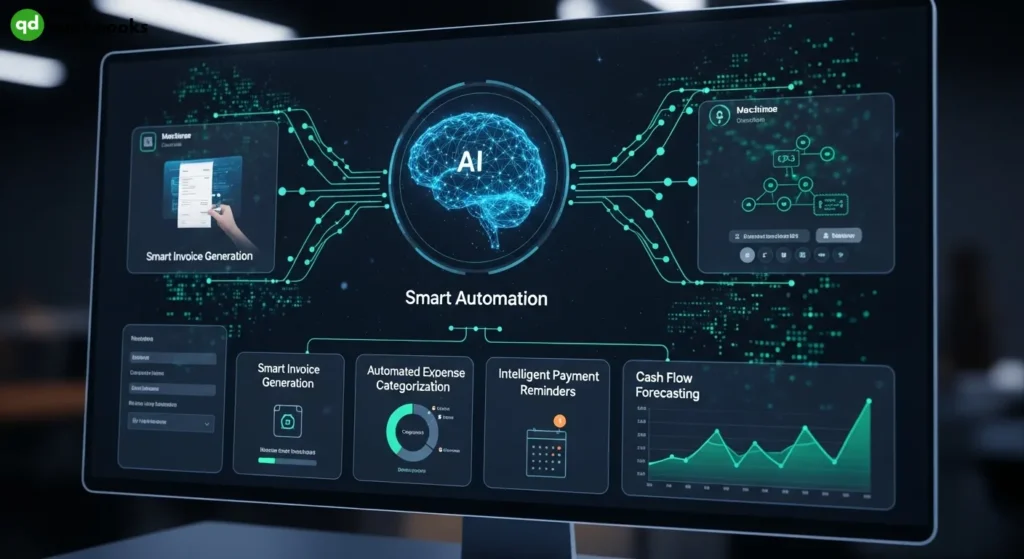

AI Technology in Intuit QuickBooks

Intuit QuickBooks’ AI-powered features transform traditional financial tasks into streamlined, automated processes. The platform’s intelligent invoicing system handles recurring billing with precision, sending automated invoices at predetermined intervals. Business owners can set custom parameters for payment reminders, allowing the AI to track unpaid invoices and send strategic follow-ups to clients.

Smart Payment Automation Features:

- Recurring invoice generation based on customizable schedules

- Intelligent payment reminder system with adjustable timing

- Automated late fee calculations and applications

- Smart matching of payments to outstanding invoices

The AI-driven payment scheduling system creates predictable cash flow patterns by analyzing historical payment data. This system identifies optimal payment timing and automates the entire collection process, reducing the manual effort required for payment tracking.

Cash Flow Benefits:

- Real-time payment status monitoring

- Automated payment reconciliation

- Predictive analytics for cash flow forecasting

- Reduced processing time for accounts receivable

QuickBooks’ AI technology extends to expense categorization, automatically sorting transactions into appropriate categories. The system learns from previous categorizations, becoming more accurate over time. This smart categorization enables:

- Instant transaction classification

- Pattern recognition for recurring expenses

- Automated receipt matching

- Tax category suggestions for deductions

The AI engine continuously adapts to business patterns, creating a more efficient financial management system. Users can customize AI-suggested categories and rules, maintaining control while benefiting from automated processes.

Payroll Services and HR Management

QuickBooks payroll services make complicated payday tasks simple and efficient. With automated calculations, the platform eliminates manual errors and ensures accurate salary payments based on various factors such as hourly rates, overtime, commissions, and bonuses.

Key Features of QuickBooks Payroll Services

- Hourly wage calculations: Easily calculate salaries based on hourly rates.

- Overtime adjustments: Automatically account for overtime hours worked.

- Salary-based payments: Process fixed salaries without any hassle.

- Commission structures: Manage commission payments for sales teams.

- Bonus distributions: Disburse bonuses accurately and on time.

The integrated time tracking system captures employee work hours through digital timesheets. This real-time data synchronization enables managers to:

- Review and approve timesheets

- Monitor attendance patterns

- Track paid time off

- Manage shift schedules

- Generate instant labor cost reports

Additional Benefits of QuickBooks Payroll Services

In addition to payroll processing, QuickBooks offers comprehensive HR management capabilities that go beyond basic functions. The platform takes care of important tasks such as tax filing and benefits administration.

Tax Filing Made Easy

With QuickBooks, you can say goodbye to the stress of tax season. The platform automates tax calculations, ensuring accuracy and saving you valuable time. Employee taxes are directly deposited into their accounts, eliminating the need for manual checks. At the end of the year, Intuit QuickBooks prepares all necessary tax forms, making it easy for you to stay compliant.

Streamlined Benefits Administration

Managing employee benefits can be complex, but Intuit QuickBooks simplifies the process. The platform allows you to track health insurance coverage, 401(k) contributions, leave balances, and workers’ compensation claims all in one place. This centralized approach saves you from juggling multiple systems and ensures that your employees receive the benefits they deserve.

Compliance Made Simple

Staying compliant with state and federal regulations is crucial for any business. Intuit QuickBooks understands this challenge and provides built-in compliance tools to help you navigate through it.

Automatic updates reflect the latest tax rates and labor laws, keeping your business protected from costly compliance errors. Whether it’s filing taxes or managing employee leave requests, Intuit QuickBooks has got you covered.

Professional HR Support at Your Fingertips

As a small business owner, having access to professional HR support can make a significant difference in managing your workforce effectively. That’s why Intuit QuickBooks offers HR Advisory Services exclusively for its users.

These experts are here to guide you on various aspects of human resources such as:

- Creating an employee handbook tailored to your company’s policies

- Designing performance review templates that align with your goals

- Developing HR policies that promote fairness and inclusivity

- Establishing workplace safety guidelines to protect your employees

Mobile Accessibility for Convenience

In today’s fast-paced world, convenience is key. QuickBooks understands this need and ensures that both employees and management can access important features anytime, anywhere through their mobile devices.

With the mobile app:

- Employees can easily clock in/out using their smartphones

- Time-off requests can be submitted on-the-go

- Pay stubs can be accessed digitally without any hassle

Customer Support and Expert Assistance

Intuit QuickBooks understands that managing business finances requires expert guidance. Their dedicated support team includes certified ProAdvisors who provide personalized assistance with:

Tax Compliance Navigation

- State-specific tax regulations

- Industry compliance requirements

- Updated reporting standards

- Tax filing deadlines

Financial Advisory Services

- Custom report interpretation

- Business performance analysis

- Growth strategy recommendations

- Cash flow optimization tips

The QuickBooks support system offers multiple channels for assistance:

- Live Chat Support – Real-time problem resolution

- Phone Consultations – Direct access to product specialists

- Video Training Sessions – Step-by-step guidance

- Community Forums – Peer-to-peer knowledge sharing

Product selection assistance ensures businesses choose the right QuickBooks version for their needs. Support specialists analyze factors such as:

- Business size and structure

- Industry requirements

- Current software ecosystem

- Growth projections

- Budget constraints

These experts help create seamless transitions between existing systems and new QuickBooks implementations, minimizing disruption to business operations while maximizing the platform’s benefits.

Conclusion

Intuit QuickBooks is a powerful tool for businesses looking to streamline their financial operations. With its wide range of time-saving solutions, it makes complex financial tasks easy to handle. Features like automated invoicing and intelligent expense tracking save businesses valuable hours that can be used for strategic growth initiatives.

What sets Intuit QuickBooks apart is its ability to adapt to different business needs. This makes it an invaluable tool for companies at any stage of development. Small startups can benefit from basic bookkeeping features, while established enterprises can use advanced analytics and customizable reporting tools.

Key Benefits for Business Growth:

- Automated financial workflows reduce manual tasks

- Real-time financial insights enable quick decision-making

- Integrated solutions create seamless business operations

- Scalable features support business expansion

By choosing Intuit Intuit QuickBooks, businesses can focus on what really matters – driving innovation, expanding market reach, and achieving sustainable growth in today’s competitive landscape.

FAQs (Frequently Asked Questions)

What is Intuit QuickBooks and who can benefit from using it?

Intuit QuickBooks is a comprehensive financial management platform designed to help businesses efficiently manage their finances. It offers key features like tracking finances, running payroll, accepting payments, and cash flow management, making it ideal for small to medium-sized businesses seeking streamlined financial operations.

How does QuickBooks simplify payroll processing for businesses?

QuickBooks streamlines payroll processing by providing automated tax calculations, direct deposit options, and accurate payday processes based on hours worked or salary rates. Its employee time tracking integrates seamlessly with payroll functionality, reducing errors and saving time during pay periods.

What financial reports and budgeting tools does Intuit QuickBooks offer for smart decision-making?

QuickBooks provides detailed reports such as profit and loss statements and expense breakdowns to support informed decision-making. Additionally, its budgeting tools allow businesses to set spending limits and track variances between actual and projected figures, enhancing financial planning and profitability.

Can QuickBooks integrate with other business tools and third-party applications?

Yes, QuickBooks offers seamless integration with key business tools like CRM software and e-commerce platforms. It also supports third-party app integrations that enhance financial management capabilities, including inventory tracking and project management functionalities for a holistic view of business finances.

How does AI technology enhance the invoicing and payment processes in Intuit QuickBooks?

AI technology in QuickBooks automates invoicing through features like recurring billing and intelligent payment reminders. It also facilitates automated payment scheduling, which improves cash flow predictability and reduces manual efforts in managing due dates, ensuring timely payments.

What kind of customer support and expert assistance does Intuit QuickBooks provide?

Intuit QuickBooks offers access to experts who provide compliance support regarding tax regulations and industry-specific financial reporting requirements. Additionally, customer support assists users in selecting the right QuickBooks product tailored to their business needs, ensuring compatibility with existing systems.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.