The zoho books vs quickbooks debate continues to dominate discussions among business owners seeking the best accounting software 2025 has to offer. Both platforms have established themselves as premier cloud accounting solutions, serving millions of businesses worldwide with comprehensive financial management capabilities.

As businesses deal with complicated financial situations, legal requirements, and operational needs, it’s becoming more and more important to choose the right accounting tool. Making the wrong decision could result in wasted time, legal problems, and limited growth potential.

In this detailed comparison of Zoho Books and QuickBooks, we’ll look at their pricing plans, features, automation abilities, integration options, and user experiences. We’ll see how each platform meets the specific needs of small and growing businesses, so you can make a smart choice that fits your requirements and budget.

If you’re looking into QuickBooks Desktop options for your business, QBO Desktop is the best provider for specialized knowledge on QuickBooks desktop solutions.

Overview of Zoho Books and QuickBooks

Zoho Books is a cloud accounting platform created by Zoho Corporation, an Indian software company known for its innovative business applications since 2005. It was specifically designed for small and medium-sized businesses looking for affordable financial management solutions. The software caters to startups, freelancers, and growing companies with annual revenues below $50,000, providing them with a user-friendly introduction to professional accounting.

QuickBooks, developed by Intuit in 1983, is one of the most well-known names in accounting software. Initially designed for desktop use, QuickBooks has evolved into powerful cloud accounting platforms that cater to businesses of all types and sizes. The platform primarily focuses on small to medium enterprises that require advanced customization options and extensive reporting capabilities.

Core Functionalities

Both platforms offer essential features that modern businesses need:

- Financial Management: Track accounts payable/receivable, reconcile bank statements, and manage expenses

- Invoicing Systems: Create professional invoices using customizable templates and send automated payment reminders

- Reporting Capabilities: Generate detailed financial reports such as profit & loss statements, balance sheets, and cash flow analyses

- Tax Compliance: Access built-in tools for tax calculations and ensure compliance with relevant regulations

- Multi-user Access: Enable multiple team members to work on financial data simultaneously through collaborative workspaces

The main differences between the two platforms lie in their methods of automation, integration options, and pricing models. These factors make each platform suitable for different business situations and growth paths.

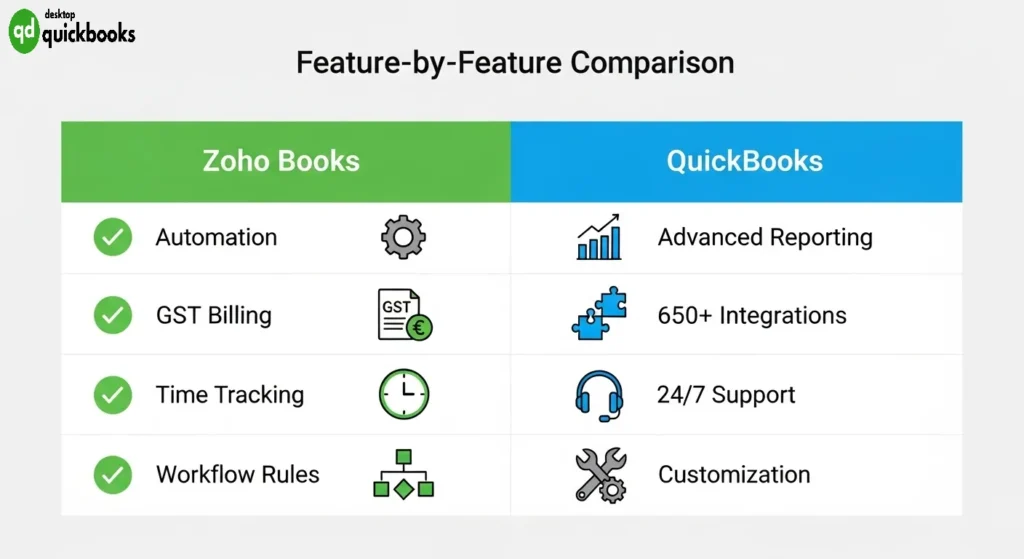

Feature Comparison

1. Accounting and Financial Management

The Zoho Books vs QuickBooks feature comparison reveals distinct approaches to core accounting functions that can significantly impact your business operations.

Accounts Payable and Receivable Management

Zoho Books streamlines accounts payable through automated vendor bill tracking and approval workflows. The platform allows businesses to set up custom approval hierarchies, ensuring proper authorization before payments. For accounts receivable, Zoho Books provides automated payment reminders and aging reports that help maintain healthy cash flow.

QuickBooks takes a more comprehensive approach to accounts payable with advanced vendor management features, including 1099 tracking and detailed payment scheduling. The platform excels in accounts receivable with sophisticated customer payment tracking, credit memo management, and automated dunning processes that can be customized based on customer payment history.

Invoice Customization and Templates

Invoicing capabilities differ significantly between platforms. Zoho Books offers approximately 16 professionally designed invoice templates with extensive customization options. Users can modify colors, fonts, logos, and field arrangements while maintaining brand consistency across all customer communications.

QuickBooks provides a broader selection of invoice templates with more advanced customization features. The platform allows for detailed product and service categorization, multiple pricing tiers, and sophisticated discount structures. QuickBooks also supports recurring invoice automation with flexible scheduling options.

Financial Reporting Depth and Variety

Financial reporting represents a key differentiator in the zoho books vs quickbooks comparison. Zoho Books delivers essential reports including profit and loss statements, balance sheets, cash flow reports, and tax summaries. The platform focuses on clarity and actionable insights for small business owners.

QuickBooks dominates with over 80 report types, offering granular financial analysis capabilities. Advanced features include customizable report templates, automated report scheduling, and detailed variance analysis. The platform provides industry-specific reporting options that cater to specialized business requirements, making it particularly valuable for businesses requiring detailed financial oversight and compliance reporting.

2. Automation and Operational Efficiency

Zoho Books stands out as a leader in automation capabilities with its advanced workflow rules and custom functions that simplify repetitive accounting tasks. The platform empowers users to set up automated rules for generating invoices, sending payment reminders, and categorizing expenses, resulting in a reduction of manual data entry by up to 70%. Additionally, custom functions allow businesses to automate intricate calculations and initiate specific actions based on predetermined conditions.

The time tracking with billable hours conversion feature in Zoho Books revolutionizes project management by turning it into a revenue-generating activity. Users have the ability to:

- Track time directly within projects and automatically convert hours into invoices

- Assign different billing rates for various team members or project types

- Generate comprehensive timesheets that seamlessly integrate with client billing

- Monitor project profitability through real-time analysis of costs

QuickBooks takes a different approach to automation, primarily focusing on matching bank transactions and scheduling recurring invoices. The platform excels at automatically categorizing transactions based on historical patterns and vendor recognition. QuickBooks’ automation features encompass automated calculations of sales tax, setups for recurring billing, and inventory reorder points that trigger purchase orders.

The impact on operational efficiency differs significantly between the two platforms. Zoho Books minimizes administrative overhead through extensive workflow automation, making it an ideal choice for service-based businesses that require detailed tracking of time. On the other hand, QuickBooks streamlines traditional accounting processes, benefiting retail and product-based businesses with needs related to inventory management. While both platforms eliminate manual errors and expedite financial processes, Zoho Books offers more precise control over automated workflows.

3. Taxation and Compliance Support

Tax compliance is a crucial factor in deciding between Zoho Books and QuickBooks, especially for businesses that operate in multiple locations or have complicated tax needs.

Zoho Books’ Strengths

Zoho Books stands out with its excellent GST billing feature, which includes built-in support for Goods and Services Tax calculations that automatically adjust based on the type of transaction and the location of the customer. The platform effortlessly manages global tax regulations, including VAT, sales tax, and other regional tax systems, without the need for extra modules. Its comprehensive tax engine automatically calculates rates and generates invoices that comply with local regulations.

The platform also offers strong payroll management capabilities through strategic integrations, particularly with Zoho Payroll, which provides:

- Automated tax deductions and compliance reporting

- Multi-state payroll processing

- Employee self-service portals for tax documents

- Direct integration with accounts payable and accounts receivable workflows

QuickBooks’ Approach

On the other hand, QuickBooks handles taxation through its established ecosystem, offering robust payroll solutions that come with additional licensing costs. The platform provides comprehensive payroll features including tax filing services, but these typically require upgrading to higher-tier plans or purchasing separate payroll subscriptions ranging from $45 to $125 monthly.

QuickBooks’ strength lies in its extensive financial reporting capabilities for tax preparation, generating detailed reports that accountants prefer for year-end filings. The platform’s invoicing system includes tax calculation features, though international tax compliance may require third-party integrations through its app marketplace.

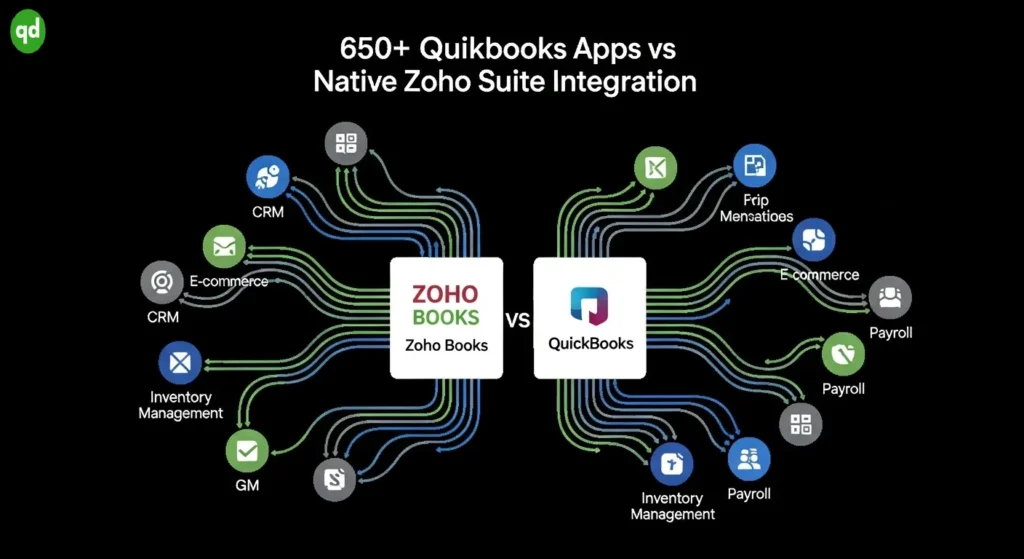

4. Integrations and Ecosystem Compatibility

The Zoho Books vs QuickBooks feature comparison reveals significant differences in their approach to third-party app integrations and ecosystem connectivity.

QuickBooks Integration Strengths:

- Massive app store with vetted third-party applications

- API compatibility with major business platforms

- Seamless data synchronization across connected applications

- Industry-specific integrations for specialized business needs

QuickBooks dominates this space with its extensive marketplace offering 650+ third-party app integrations, creating a robust ecosystem that connects with popular business tools across various categories including CRM, e-commerce, inventory management, and specialized industry solutions.

Zoho Suite Integration Benefits:

- Native connectivity with Zoho CRM, Inventory, Projects, and Payroll

- Single sign-on across all Zoho applications

- Unified data management without additional integration costs

- Consistent user interface across the entire suite

Zoho Books takes a different approach, focusing on seamless integration within the Zoho product suite. While the third-party app selection is more limited compared to QuickBooks, the native integration with Zoho’s ecosystem creates a unified business management experience.

Both platforms enhance functionality through their respective integration strategies. QuickBooks excels for businesses requiring diverse third-party connections, while Zoho Books provides exceptional value for companies already invested in the Zoho ecosystem. The choice between extensive third-party options versus deep native integration depends on your existing software infrastructure and business requirements.

For businesses seeking comprehensive QuickBooks desktop solutions, QBO Desktop offers expert guidance on maximizing these integration capabilities.

5. User Interface, Experience, and Mobile Accessibility

The user interface comparison between these platforms reveals distinct approaches to dashboard design and user experience.

QuickBooks

QuickBooks delivers a simpler dashboard that resonates with users who prioritize straightforward navigation and clear visual hierarchy. The platform’s interface focuses on essential accounting functions with intuitive menu structures that help non-accountants quickly locate features like accounts payable, accounts receivable, and invoicing tools.

- Dashboard usability differs significantly between the two solutions.

- QuickBooks emphasizes clean layouts with prominent action buttons and streamlined workflows, making it accessible for users without extensive accounting backgrounds.

- The platform’s design philosophy centers on reducing complexity while maintaining comprehensive functionality for financial reporting and core accounting tasks.

Zoho Books

Zoho Books takes a feature-rich approach to interface design, offering more customization options within the dashboard. While this provides greater flexibility, some users find the learning curve steeper compared to QuickBooks’ more straightforward presentation.

Mobile Applications Comparison

Mobile applications showcase Zoho Books’ competitive advantage through extensive device compatibility. The platform supports:

- Android smartphones and tablets

- iOS devices (iPhone and iPad)

- Windows tablets for touch-screen functionality

- Kindle devices for basic access

This cross-platform approach ensures users can manage their accounting tasks regardless of their preferred mobile device. QuickBooks offers solid mobile apps for iOS and Android but lacks the broader device ecosystem that Zoho Books provides, particularly for Windows tablet users who prefer touch-optimized interfaces for their accounting workflows.

For businesses using QuickBooks Desktop, mobile accessibility becomes even more critical as a complement to desktop-based operations.

Pricing Plans and Value for Money Evaluation

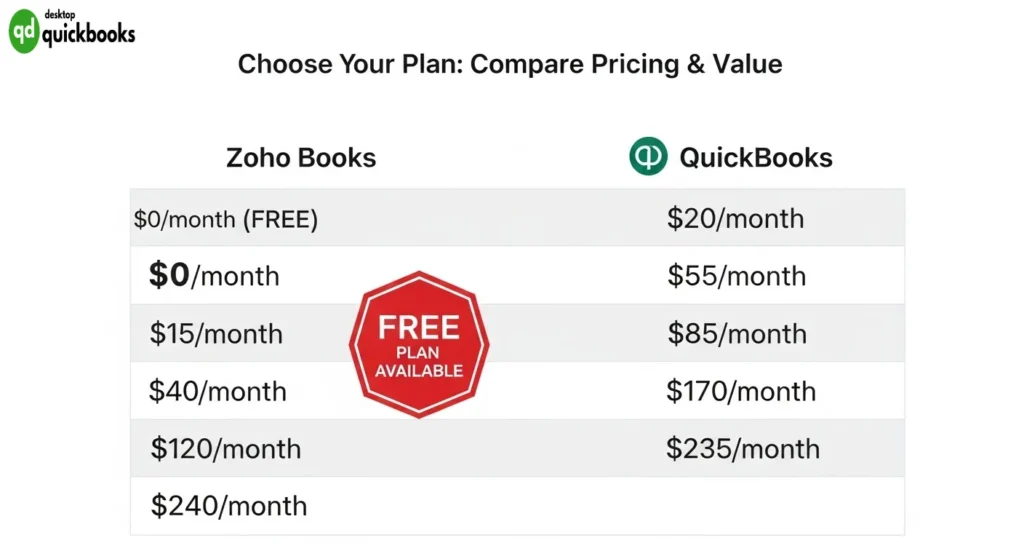

The pricing comparison between these platforms reveals distinct approaches to affordability and feature accessibility. Zoho Books stands out with its free plan Zoho Books offering, supporting businesses with annual revenue under $50,000. This plan accommodates one user and up to 1,000 invoices yearly, making it ideal for startups and freelancers.

Zoho Books’ paid plans range from $15 to $240 monthly, scaling with user count and advanced features. The entry-level Standard plan at $15 supports 3 users, while the Professional plan ($40) adds project management and custom fields. The Premium tier ($60) includes workflow automation and advanced reporting.

QuickBooks subscription tiers QuickBooks start at $20 monthly for Simple Start, progressing to Essentials ($35), Plus ($55), and Advanced ($235). While lacking a free option, QuickBooks provides a comprehensive 30-day trial across all plans.

Cost-effectiveness analysis favors Zoho Books for budget-conscious businesses, particularly those already within the Zoho ecosystem. QuickBooks justifies its higher pricing through extensive third-party integrations, advanced reporting capabilities, and 24/7 support. Small businesses prioritizing automation and affordability benefit from Zoho Books, while companies requiring robust customization and comprehensive analytics find value in QuickBooks’ premium pricing structure.

For QuickBooks desktop solutions, QBO Desktop offers specialized support and expertise.

Customer Support, Training Resources, Ideal Use Cases & Business Fit

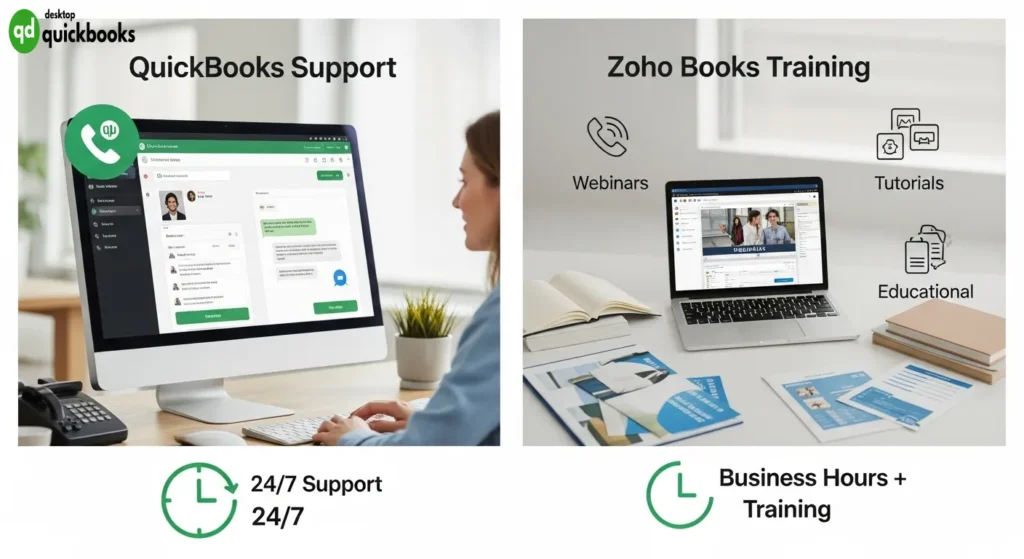

Customer support hours vary significantly between these platforms. QuickBooks provides 24/7 live support availability including weekends, complemented by chatbot assistance for immediate responses. Zoho Books operates on business hours (typically 9am-6pm weekdays) for voice calls, chat, and email support.

Training materials showcase distinct approaches. Zoho Books offers extensive educational resources including webinars, video tutorials, online lessons, text materials, and in-person training options. QuickBooks focuses on comprehensive documentation and community forums alongside their direct support channels.

Support responsiveness directly impacts software adoption success. Businesses requiring immediate assistance benefit from QuickBooks’ round-the-clock availability, while those preferring structured learning appreciate Zoho Books’ comprehensive training ecosystem.

Zoho Books vs QuickBooks suitability depends on specific business needs:

- Zoho Books excels for small businesses or organizations already integrated within the Zoho ecosystem, leveraging competitive pricing and powerful automation capabilities

- QuickBooks serves businesses requiring advanced customization options, comprehensive reporting tools, and extensive third-party integrations

The choice between platforms should align with your company’s size, technical requirements, and preferred support model. Consider your team’s accounting expertise and the complexity of financial operations when evaluating these solutions through QBO Desktop.

Which Software is Best for 2025? Conclusion

Choosing the best accounting software 2025 conclusion depends on your specific business needs and operational priorities.

For Small Businesses

Small businesses with revenue under $50,000 can benefit greatly from Zoho Books’ free plan and powerful automation features. Companies that are already using other Zoho products find it extremely valuable to have everything connected for smoother operations.

For Budget-Conscious Businesses

Budget-conscious businesses should prioritize:

- Zoho Books for comprehensive features at lower costs

- Free plan availability for startups and micro-businesses

- Competitive pricing across all subscription tiers

For Feature-Intensive Operations

Feature-intensive operations require:

- QuickBooks for advanced reporting capabilities and customization

- Extensive third-party integrations through 650+ available apps

- Professional invoicing and comprehensive financial analytics

For Support Requirements

Support requirements vary significantly:

- 24/7 assistance needs favor QuickBooks’ round-the-clock availability

- Business hours support suffices for most small to medium enterprises using Zoho Books

Both platforms offer trial periods allowing hands-on evaluation. QBO Desktop provides additional QuickBooks desktop solutions for businesses requiring offline functionality. Testing both systems with your actual business data reveals which interface, feature set, and workflow aligns best with your operational needs and growth projections.

Try Both Software Hands-On!

The best way to determine which platform suits your business needs is through direct experience. Try Zoho Books free plan to explore its automation capabilities and seamless workflow features without any financial commitment. The free tier supports businesses with revenue under $50,000, making it perfect for testing core functionalities.

For QuickBooks evaluation, take advantage of their QuickBooks free trial 2025 offering. The 30-day trial provides full access to premium features, allowing you to assess their comprehensive reporting tools and extensive third-party integrations.

When comparing Zoho Books vs QuickBooks, hands-on testing reveals interface preferences, workflow compatibility, and feature relevance to your specific business operations. Both platforms offer demo sessions and guided tours to help you navigate their capabilities effectively.

Start your evaluation today by signing up for both offerings. For QuickBooks desktop solutions, consider exploring options through QBO Desktop as the best QuickBooks desktop provider. Make your decision based on real-world usage rather than feature lists alone.

FAQs (Frequently Asked Questions)

What are the main differences between Zoho Books and QuickBooks for small businesses in 2025?

Zoho Books and QuickBooks are both leading cloud-based accounting software platforms tailored for small to growing businesses. Zoho Books offers strong automation features, GST billing support, seamless integration within the Zoho suite, and a free plan option, making it ideal for small businesses or those already using Zoho products. QuickBooks provides advanced customization, comprehensive financial reporting, a vast third-party app ecosystem (650+ apps), and 24/7 live customer support, suiting businesses needing extensive features and robust support.

How do Zoho Books and QuickBooks compare in terms of pricing and value for money?

Zoho Books offers a free plan along with subscription tiers ranging from $15 to $240 per month, providing cost-effective options especially for small businesses. QuickBooks pricing ranges from $20 to $235 per month without a free plan but includes a 30-day trial period. When evaluating value for money, Zoho Books stands out for its affordability combined with automation benefits, while QuickBooks is preferred by users requiring advanced features and reporting capabilities.

What accounting and financial management features do Zoho Books and QuickBooks provide?

Both platforms handle accounts payable and receivable efficiently, offer customizable invoicing templates, and deliver robust financial reporting options. Zoho Books emphasizes automation in workflow rules and time tracking with billable hour conversion. QuickBooks focuses on comprehensive customization of invoices and detailed financial reports suited for complex business needs.

Can you explain the taxation and compliance support available in Zoho Books versus QuickBooks?

Zoho Books supports GST billing and complies with global tax regulations, offering payroll management through integrations like Zoho Payroll. QuickBooks provides payroll services as well but often involves additional costs. Both platforms assist businesses in maintaining tax compliance effectively, though Zoho Books may be more advantageous for companies operating in regions requiring GST support.

How do integrations and ecosystem compatibility differ between Zoho Books and QuickBooks?

QuickBooks boasts an extensive third-party app ecosystem with over 650 integrations, enhancing its functionality across various business needs. Zoho Books excels in seamless integration within the broader Zoho product suite and offers API compatibility to connect with other applications. These integration capabilities allow users on both platforms to tailor their accounting solutions to their specific operational workflows.

What customer support options are available for users of Zoho Books compared to QuickBooks?

QuickBooks offers 24/7 live support including weekends along with chatbot assistance, ensuring round-the-clock help. Zoho Books provides customer support during business hours via voice calls, chat, and email, supplemented by extensive training resources such as webinars and tutorials. The choice depends on the user’s need for immediate assistance versus access to comprehensive educational materials.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.