QuickBooks Merchant Services, now known as QuickBooks Payments, is a powerful payment processing solution integrated directly into QuickBooks. This integration allows for a smooth connection between your payment processing and financial management tasks.

Imagine this: Your business receives a credit card payment, and the transaction is automatically recorded in your books. That’s the magic of QuickBooks Merchant Services. The platform handles:

- Credit card transactions

- Debit card payments

- ACH bank transfers

- Digital payments

- Mobile payments

In today’s fast-paced business world, efficient payment processing is essential. Your customers expect quick and secure payment options, while you require accurate and real-time financial data. QuickBooks Merchant Services fills this gap by combining both functions into one unified system.

The service simplifies complex payment processes into easy-to-manage tasks. When you receive a payment, the system:

- Records the transaction instantly

- Updates your books automatically

- Reconciles your accounts

- Generates relevant reports

This integration eliminates the need for double data entry, reduces human error, and saves valuable time that you can invest in growing your business. QuickBooks Merchant Services serves as your virtual payment assistant, taking care of the heavy lifting of payment processing while ensuring your financial records are accurate and up-to-date.

How QuickBooks Merchant Services Works

QuickBooks Merchant Services operates as a comprehensive payment processing system directly integrated into your QuickBooks accounting software. The service handles transactions through multiple channels:

Credit and Debit Card Processing

- Point-of-Sale (POS) transactions using card readers

- Manual entry of card information for phone orders

- Virtual terminal access for remote payment processing

- Automatic card data encryption and secure storage

ACH Bank Transfers

- Direct bank-to-bank transfers for recurring payments

- eCheck processing capabilities

- Reduced processing fees compared to card payments

- Typically 2-3 business days settlement time

Payment Flow Process

- Customer initiates payment through their preferred method

- QuickBooks Merchant Services verifies payment information

- Funds are processed through secure payment networks

- Transaction details automatically sync with your QuickBooks accounts

- Payment confirmation sent to both merchant and customer

Real-Time Integration Benefits

- Instant transaction recording in your accounting system

- Automatic payment matching with invoices

- Real-time account balance updates

- Simplified reconciliation process

- Reduced manual data entry errors

Processing Capabilities

- Same-day deposits for eligible transactions

- Multi-currency payment acceptance

- Batch processing for multiple transactions

- Custom payment receipt generation

- Detailed transaction reporting

The system employs advanced encryption standards to protect sensitive payment data during transmission. Each transaction undergoes automated fraud screening, helping protect your business from unauthorized charges.

Business Account Dashboard

- Track pending and completed transactions

- Monitor processing fees

- Access detailed transaction histories

- Generate custom payment reports

- Manage customer payment information

QuickBooks Merchant Services adapts to various business models, whether you’re running a retail store, providing services, or managing an online business. The platform scales with your business growth, allowing you to add new payment methods or adjust processing volumes as needed.

Payment Acceptance Methods

- In-store payments via card readers

- Online invoice payments

- Mobile payment processing

- Recurring billing setup

- Digital wallet compatibility

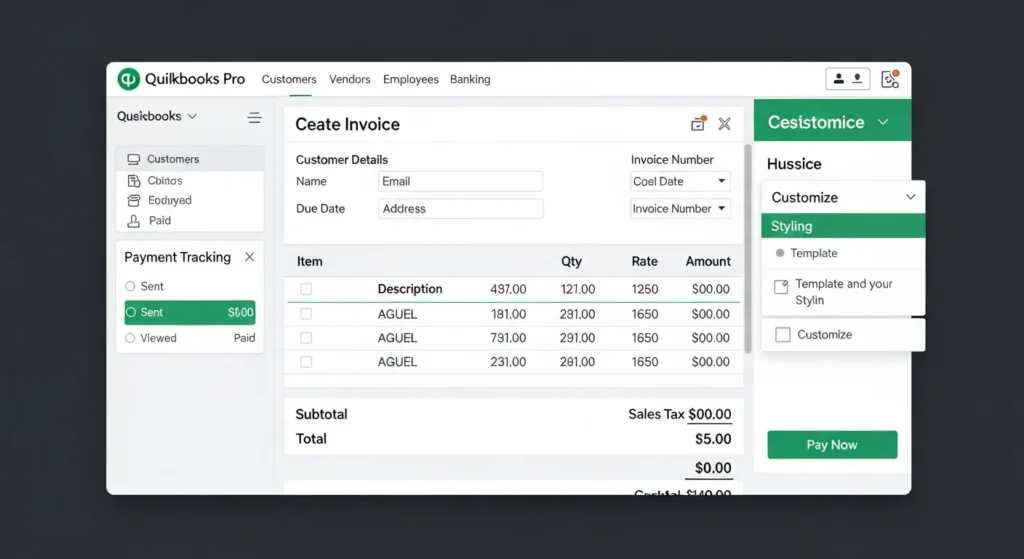

Key Features of QuickBooks Merchant Services

QuickBooks Merchant Services offers a comprehensive suite of payment acceptance features designed to meet diverse business needs:

In-Person Payments

- Card reader compatibility with major credit and debit cards

- Point-of-sale integration for retail locations

- Instant payment confirmation and receipt generation

- Real-time inventory tracking with each transaction

- Support for contactless payments and digital wallets

Online Invoices

- Customizable invoice templates with your business branding

- “Pay Now” buttons for immediate customer action

- Automated payment reminders for outstanding invoices

- Batch invoicing capabilities for multiple customers

- Real-time payment status tracking

- Direct deposit of funds into your business account

Mobile Payments

- Free mobile card reader for smartphones and tablets

- Secure payment processing on-the-go

- GPS tracking for mobile transactions

- Digital signature capture

- Instant receipt delivery via email or text

These features create a streamlined payment collection process by:

Automated Bookkeeping

- Direct synchronization with QuickBooks accounting software

- Automatic transaction recording and categorization

- Real-time updates to customer accounts

- Simplified reconciliation process

Payment Flexibility

- Multiple payment options for customers

- Same-day deposits for eligible transactions

- Custom payment schedules for recurring billing

- Split payment capabilities for large transactions

Business Intelligence

- Detailed transaction reporting

- Customer payment history tracking

- Sales trend analysis

- Payment method usage statistics

- Revenue forecasting tools

The integration of these features within QuickBooks creates a unified platform where payment processing and financial management work together seamlessly. Businesses can track every dollar from the moment a payment is initiated through its final reconciliation in their books.

Each payment method adapts to specific business scenarios – retail stores benefit from in-person payments, service providers utilize online invoices, and mobile businesses leverage the flexibility of mobile payments. This versatility allows businesses to accept payments in ways that best suit their operational model and customer preferences.

Ensuring Secure Transactions with QuickBooks Merchant Services

Security is the top priority for QuickBooks Merchant Services’ payment processing system. The platform uses multiple layers of protection to keep your business transactions safe:

Advanced Encryption Technology

- End-to-end data encryption for all transactions

- SSL security protocols to protect sensitive information

- Secure storage of customer payment data

- PCI DSS compliance certification

Fraud Prevention Measures

- Real-time fraud monitoring systems

- Address Verification Service (AVS)

- Card security code verification

- Suspicious activity alerts

- IP address tracking for online transactions

Transaction Security Features

- Tokenization of credit card information

- Automated security updates

- Two-factor authentication options

- Secure payment gateway integration

QuickBooks Merchant Services offers dedicated security support through various channels:

24/7 Security Support

- Live chat assistance for immediate concerns

- Phone support for complex security issues

- Email support with detailed documentation

- Security incident response team

The platform’s security system actively monitors transaction patterns to detect potential fraud. You’ll receive instant notifications for:

- Unusual transaction amounts

- Multiple failed payment attempts

- Transactions from high-risk locations

- Suspicious customer behavior patterns

QuickBooks Merchant Services follows strict security protocols for dispute resolution and chargeback protection. The system automatically documents transaction details, creating audit trails for every payment processed through your account.

The platform’s security infrastructure undergoes regular updates and testing to address emerging threats. Your business benefits from continuous security improvements without service interruptions or additional setup requirements.

A dedicated merchant security portal gives you direct access to:

- Security settings configuration

- Transaction monitoring tools

- Fraud prevention parameters

- Security report generation

- Risk management resources

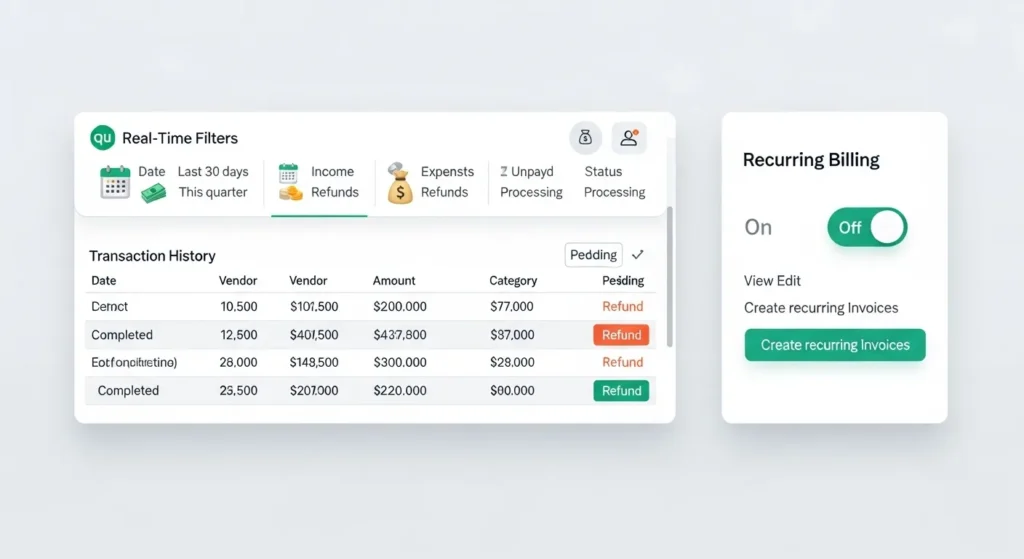

Efficient Transaction Management with QuickBooks Merchant Services

QuickBooks Merchant Services transforms complex transaction management into a streamlined process through its comprehensive dashboard and integrated features.

Payment History Access

- View detailed transaction records with customer information

- Track payment status in real-time

- Filter transactions by date, amount, or payment type

- Download customized transaction reports

- Access historical data for financial analysis

Chargeback Management Tools

- Receive instant notifications for disputed charges

- Upload supporting documentation directly through the platform

- Track dispute resolution progress

- Implement preventive measures based on chargeback patterns

- Store transaction evidence systematically

The platform’s automated reconciliation system matches payments with invoices, eliminating manual data entry and reducing errors. You can process refunds directly through the dashboard, maintaining accurate records of all payment adjustments.

Time-Saving Features

- Batch processing for multiple transactions

- Automated payment status updates

- Quick search functionality for specific transactions

- Customizable transaction categories

- Instant receipt generation and delivery

QuickBooks Merchant Services allows you to set up recurring payment schedules for regular customers, reducing administrative workload and ensuring consistent cash flow. The system automatically flags suspicious transactions, helping you identify and prevent potential payment issues before they escalate.

Transaction Analytics

- Sales trend visualization

- Payment method distribution

- Customer payment patterns

- Decline rate monitoring

- Settlement time tracking

The platform’s mobile capabilities enable you to manage transactions on-the-go, providing real-time updates and allowing immediate response to payment-related issues. You can authorize team members with different access levels, maintaining security while delegating transaction management responsibilities.

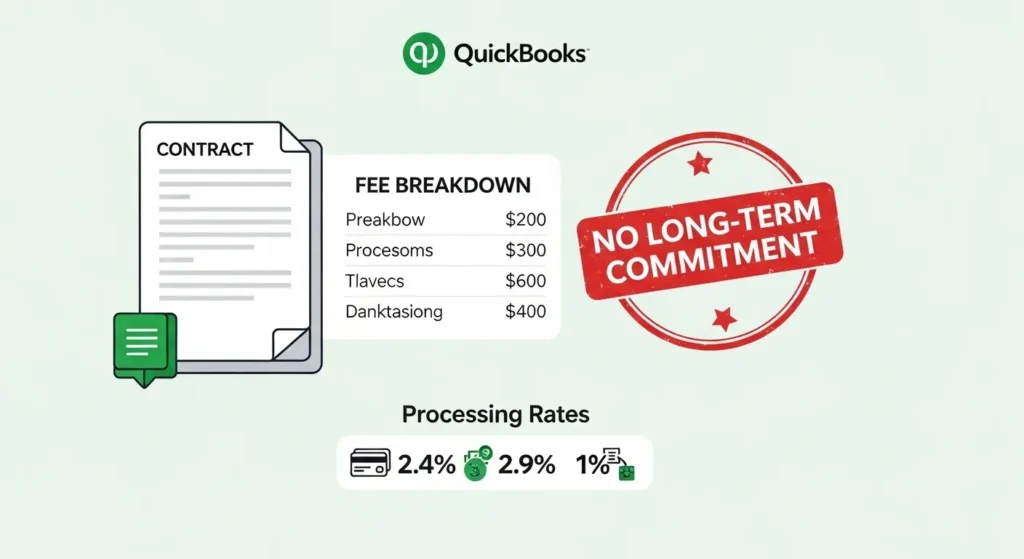

Understanding Terms and Policies of QuickBooks Merchant Services

QuickBooks Merchant Services operates under specific terms and conditions that businesses need to understand before signing up. Here’s a breakdown of essential policies and fee structures:

Standard Fee Structure:

- Per-transaction fees: 2.4% + $0.25 for card-present transactions

- Online payments: 2.9% + $0.25 per transaction

- ACH bank transfers: 1% (maximum $10 per transaction)

- Monthly service fees vary based on your plan

Key Terms to Consider:

- Minimum processing requirements

- Reserve account requirements for high-risk businesses

- Chargeback fees ($25 per instance)

- Early termination penalties

- Fund holding periods (typically 2-3 business days)

Account Limitations:

- Maximum transaction limits

- Daily processing caps

- Restricted business types

- International payment restrictions

Compliance Requirements:

- PCI compliance certification

- Regular account reviews

- Business verification documentation

- Annual security assessments

Service Agreement Highlights:

- Month-to-month contracts available

- No long-term commitments required

- Rate adjustments with notice

- Account termination policies

Additional Fees:

- PCI non-compliance fees

- Account maintenance fees

- Statement fees

- Batch processing fees

- Equipment rental or purchase costs

QuickBooks Merchant Services provides detailed fee disclosures and service agreements during the application process. You’ll receive a comprehensive merchant agreement outlining specific terms for your business type and processing volume. The platform maintains the right to adjust rates based on processing history and risk assessment.

User Experience and Customer Feedback on QuickBooks Merchant Services

QuickBooks Merchant Services receives mixed feedback from its user base, with distinct advantages and challenges reported across different business sectors.

Integration Benefits

- Seamless sync between payment processing and accounting records

- Real-time transaction updates in QuickBooks accounts

- Automated reconciliation reducing manual data entry

- Direct deposit capabilities for faster access to funds

User Interface Experience

- Clean dashboard design with intuitive navigation

- Mobile-friendly interface for on-the-go management

- Simple invoice creation and payment tracking

- Built-in reporting tools for transaction analysis

Many small business owners praise the platform’s convenience, particularly highlighting the time saved through automated bookkeeping. A retail store owner shares: “The automatic sync between payments and my books has cut my accounting time in half.”

Customer Service Performance

- Phone support available Monday through Friday

- Email response times averaging 24-48 hours

- Limited weekend support options

- Mixed reviews on problem resolution speed

The platform’s market competitiveness shows varying results:

Pricing Structure

- Higher processing rates compared to standalone merchant services

- Additional fees for certain transaction types

- No long-term contracts required

- Volume discounts available for larger businesses

Recent user reviews indicate satisfaction with the platform’s reliability but note concerns about:

- Response times during peak business hours

- Complex dispute resolution processes

- Limited customization options for payment forms

- Higher fees compared to alternative payment processors

Business users particularly value the direct integration into financial workflows, citing reduced errors and improved cash flow management. A service business owner notes: “Despite higher fees, the time saved on reconciliation makes it worth the investment.”

The platform’s learning curve receives positive feedback, with new users typically reporting comfortable navigation within the first week of implementation. Regular system updates and feature additions demonstrate QuickBooks’ commitment to platform improvement, though some users request more frequent communication about these changes.

Final Thoughts on QuickBooks Merchant Services for Businesses

QuickBooks Merchant Services is a powerful payment processing solution that offers significant benefits to businesses through its seamless integration with QuickBooks accounting software. The platform excels in several key areas:

- All-in-One Payment Processing: QuickBooks Merchant Services allows businesses to accept various payment methods, including credit and debit card transactions, ACH bank transfers, mobile payments, and in-person transactions.

- Business-Critical Features: The platform offers features that are essential for businesses, such as real-time payment tracking, automated bookkeeping, fraud protection measures, and comprehensive transaction management.

The ability of QuickBooks Merchant Services to streamline payment operations while ensuring security standards makes it an attractive choice for businesses looking for efficiency in their financial operations. The automatic synchronization of payments with your accounting records is particularly beneficial, as it eliminates manual data entry and reduces the risk of errors.

Small to medium-sized businesses can take advantage of the scalable solutions offered by QuickBooks Merchant Services, which can adapt to increasing transaction volumes. Although there have been mixed reviews about customer service, the core functionality of the platform provides reliable payment processing capabilities.

For businesses already using QuickBooks accounting software, integrating QuickBooks Merchant Services is a logical step towards achieving streamlined financial management. The combination of payment processing, security features, and automated accounting positions QuickBooks Merchant Services as a practical choice for businesses prioritizing operational efficiency and integrated financial solutions.

FAQs (Frequently Asked Questions)

What is QuickBooks Merchant Services and how does it integrate with QuickBooks accounting software?

QuickBooks Merchant Services is a payment processing solution that seamlessly integrates with QuickBooks accounting software, enabling businesses to efficiently manage their payments and financial records in one platform.

Which payment methods are supported by QuickBooks Merchant Services?

QuickBooks Merchant Services supports various payment methods including credit cards, debit cards, ACH bank transfers, in-person payments, online invoices, and mobile payments, providing flexibility for businesses to accept payments.

How does QuickBooks Merchant Services ensure secure transactions?

QuickBooks Merchant Services prioritizes secure payment processing by implementing fraud protection measures and offering customer support within the platform to address any security-related concerns, ensuring the safety of all transactions.

What features does QuickBooks Merchant Services offer for efficient transaction management?

The service offers features such as viewing payment history, managing transactions effectively, and handling chargebacks efficiently, helping businesses maintain organized and streamlined transaction processes.

What are the key terms and fees associated with using QuickBooks Merchant Services?

Businesses should review the terms of service agreements carefully, which include details on associated fees for payment processing. Understanding these terms helps in making informed decisions when using QuickBooks Merchant Services.

How do users rate the convenience and integration capabilities of QuickBooks Merchant Services?

Users appreciate the convenience and ease of use of QuickBooks Merchant Services, highlighting its seamless integration into financial workflows. Customer feedback often notes responsive customer service and competitive positioning in the market.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.