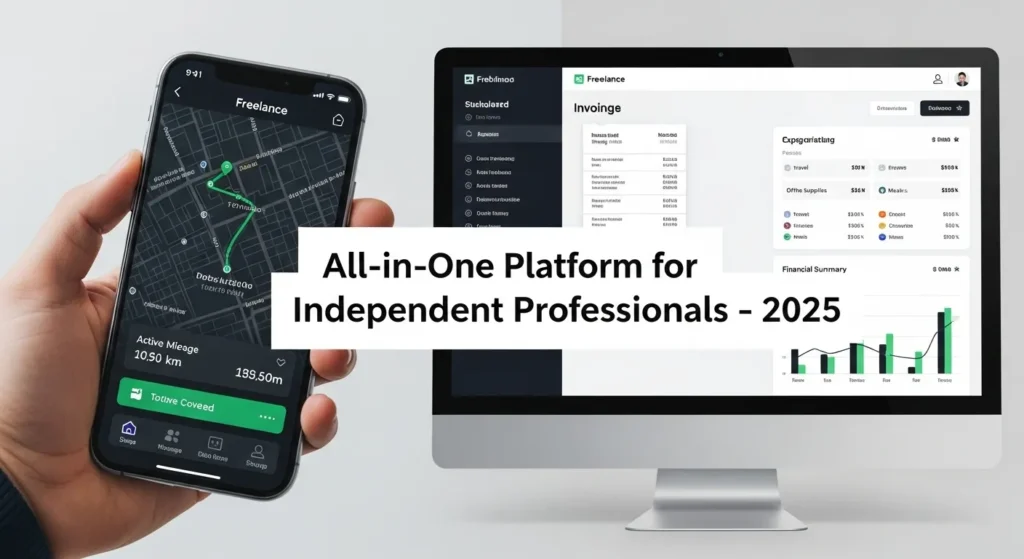

QuickBooks Self-Employed is a financial management platform designed specifically for freelancers and independent contractors. It streamlines essential business operations, making it an indispensable resource for self-employed professionals.

The QuickBooks Self Employed login portal allows you to access:

- Real-time financial tracking

- Professional invoice creation

- Automated expense categorization

- Tax preparation tools

- Mileage tracking capabilities

By logging in securely, you can access these features and maintain control over your business finances. The user-friendly interface makes it easy to navigate between functions, saving you time and ensuring accuracy in financial management.

For self-employed professionals, keeping organized financial records is crucial for success. The QuickBooks Self Employed Login system provides a centralized hub where you can monitor your business’s financial health, prepare for tax season, and make informed decisions about your operations. This systematic approach helps reduce errors, save time, and ensure compliance with tax regulations.

Understanding QuickBooks Self Employed Login

QuickBooks Self Employed Login is a powerful financial management tool designed for freelancers, independent contractors, and small business owners. It offers a wide range of features to help streamline business operations and keep track of finances.

Essential Features After Login:

1. Intelligent Mileage Tracking

- Automatic GPS tracking for business trips

- Manual trip logging options

- IRS-compliant mileage records

- Real-time calculation of tax deductions

2. Smart Expense Management

- Automatic transaction categorization

- Receipt capture and storage

- Business vs. personal expense separation

- Custom category creation

3. Professional Invoice Creation

- Customizable invoice templates

- Multiple payment acceptance options

- Automated payment reminders

- Invoice status tracking

Financial Management Benefits:

1. Tax Preparation Tools

- Quarterly tax estimation

- Schedule C form auto-population

- Tax category assignment

- Deduction maximization

2. 1099 Form Management

- Free account access for 1099 viewing

- Digital form storage

- Year-round accessibility

- Simple form organization

3. Banking Integration

- Direct bank feed connections

- Real-time transaction updates

- Multi-account management

- Secure data encryption

The platform’s intuitive dashboard presents all financial data in clear, actionable formats. Users gain immediate insights into profit and loss statements, expense breakdowns, and upcoming tax obligations. The self-employment income tracker helps maintain accurate records for multiple income streams, while the expense categorization system applies rules to automatically sort transactions into appropriate tax categories.

QuickBooks Self Employed Login mobile app extends these capabilities beyond the desktop, allowing users to capture receipts, track mileage, and manage invoices on the go. The platform’s cloud-based nature ensures data synchronization across all devices, maintaining consistent and current financial records.

Step-by-Step Guide to QuickBooks Self Employed Login

Accessing your QuickBooks Self Employed Login account starts with a simple account creation process. Here’s a detailed walkthrough to get you started:

Creating a New Account

- Visit the QuickBooks Self Employed Login website

- Click “Sign Up Now” or “Get Started”

- Enter your email address

- Create a strong password (minimum 8 characters)

- Fill in your business information

- Select your subscription plan

- Add payment details

Secure Login Process

- Navigate to the QuickBooks Self Employed login page

- Enter your registered email address

- Input your password

- Click “Sign In”

Password Security Tips

- Use a combination of uppercase and lowercase letters

- Include numbers and special characters

- Avoid using personal information

- Create unique passwords for each financial account

- Change passwords every 90 days

Supported Platforms for Access

Desktop Browsers

- Google Chrome (Version 89 or higher)

- Mozilla Firefox (Version 85 or higher)

- Safari (Version 14 or higher)

- Microsoft Edge (Version 89 or higher)

Mobile Devices

- iOS devices running iOS 13 or later

- Android devices running version 8.0 or later

- QuickBooks Self Employed Login mobile app

Login Best Practices

- Bookmark the official QuickBooks Self Employed login page

- Double-check the URL before entering credentials

- Enable device fingerprinting for added security

- Keep your browser updated

- Clear browser cache if experiencing login issues

Device Requirements

- Stable internet connection (minimum 1 Mbps)

- Updated operating system

- Sufficient RAM (minimum 4GB recommended)

- Screen resolution of 1280×800 or higher

The QuickBooks login process includes additional security measures such as device verification. When logging in from a new device, you’ll receive a verification code via email or text message to confirm your identity.

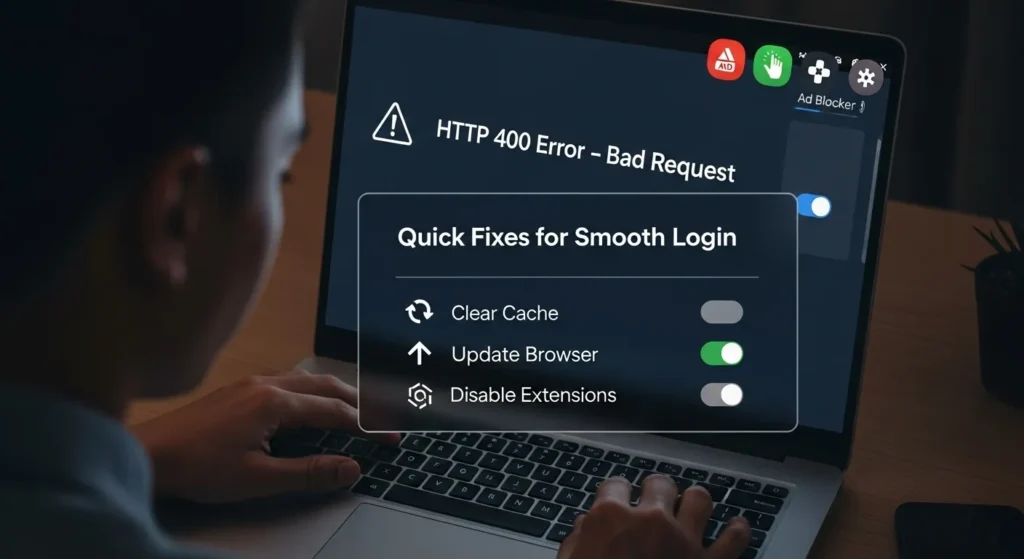

Common Issues Encountered During QuickBooks Self-Employed Login

Users frequently encounter specific login errors when accessing their QuickBooks Self-Employed accounts. Understanding these common issues helps identify and resolve them quickly.

1. HTTP Status 400 – Bad Request Error

This error typically appears due to:

- Corrupted browser cache

- Outdated cookies

- Incompatible browser versions

- Server-side validation failures

2. Browser Extension Interference

Several browser extensions can disrupt the QuickBooks login process:

- Ad blockers preventing page elements from loading

- Security tools blocking authentication scripts

- Password managers conflicting with login forms

- VPN services causing location verification issues

3. Cache and Cookie-Related Problems

The QuickBooks Self Employed Login platform relies heavily on browser data to function properly. Login issues often stem from:

- Expired session cookies

- Corrupted local storage

- Conflicting cached credentials

- Cross-site tracking prevention

4. Browser Compatibility Issues

Login problems can arise from:

- Using unsupported browser versions

- Missing browser updates

- Disabled JavaScript

- Incompatible security settings

5. Security Tool Conflicts

Built-in browser security features may interfere with the login process:

- Pop-up blockers preventing authentication windows

- Enhanced tracking protection blocking necessary scripts

- Strict privacy settings limiting cookie access

- Firewall settings blocking secure connections

6. Connection-Related Issues

Network problems affecting login success:

- Unstable internet connections

- DNS resolution errors

- Proxy server conflicts

- IP address restrictions

These technical barriers can prevent successful access to QuickBooks Self Employed Login accounts. Each issue requires specific troubleshooting approaches to restore normal login functionality.

Troubleshooting QuickBooks Self Employed Login Problems

Resolving QuickBooks Self Employed Login issues requires a systematic approach. Here’s a detailed guide to get you back into your account:

1. Clear Browser Cache and Cookies for Intuit

- Access your browser settings

- Navigate to privacy/history section

- Select “Custom Clear Data”

- Check boxes for:

- Cached images and files

- Cookies and site data

- Set time range to “All time”

- Enter “intuit.com” in the site search

- Click “Clear Data”

2. Update Your Browser

- Chrome users: Click three dots > Help > About Google Chrome

- Firefox users: Click menu > Help > About Firefox

- Safari users: Apple menu > App Store > Updates

- Edge users: Three dots > Help and feedback > About Microsoft Edge

3. Browser Compatibility Check

- Chrome (Version 90+)

- Firefox (Version 88+)

- Safari (Version 14+)

- Microsoft Edge (Version 90+)

4. Disable Extensions Temporarily

- Open browser settings

- Locate extensions/add-ons section

- Toggle off:

- Ad blockers

- Security tools

- Password managers

- Attempt login

- Re-enable extensions one by one

5. Alternative Browser Method

- Launch an alternative supported browser

- Access QuickBooks Self Employed Login login page

- Enter credentials

- Test functionality

6. Check System Requirements

- Operating system up to date

- Stable internet connection

- Minimum 2GB RAM

- Screen resolution 1280×800

If these steps don’t resolve your login issues, try accessing QuickBooks Self-Employed through your mobile device. The mobile app often provides a reliable alternative when browser-based access encounters problems.

When and How to Contact QuickBooks Customer Care Support

QuickBooks Customer Care Support is available to help users with persistent login issues that basic troubleshooting can’t fix. The support team is available Monday to Friday, from 6 AM to 6 PM PT, and offers expert assistance through various channels.

Contact Support When:

- Login attempts fail after clearing cache and cookies

- Password reset emails aren’t arriving

- Account security alerts appear unexpectedly

- Two-factor authentication issues persist

- Bank connection problems prevent access

- Error messages remain after browser updates

Available Support Channels:

- Live Chat: Access through QuickBooks Online help section

- Phone Support: Request a callback through your account

- Help Portal: Self-service articles and community forums

Required Information for Support:

- Account email address

- Phone number linked to account

- Recent error messages (screenshots if possible)

- Browser and device details

- Steps already attempted to resolve the issue

Security Verification Process:

- Support agents will verify your identity

- You may need to provide:

- Last four digits of associated payment method

- Recent transaction details

- Business identification numbers

- Security questions answers

Priority Support Access:

Users with active subscriptions receive prioritized support handling. Free account holders viewing 1099 forms can access basic support services through the help portal.

Support Experience Tips:

- Document all troubleshooting steps taken

- Keep error messages and screenshots handy

- Note exact times when issues occur

- List any recent account changes

- Have backup login methods available

QuickBooks support agents follow strict security protocols to protect user data. They never request full passwords or sensitive financial information during support interactions.

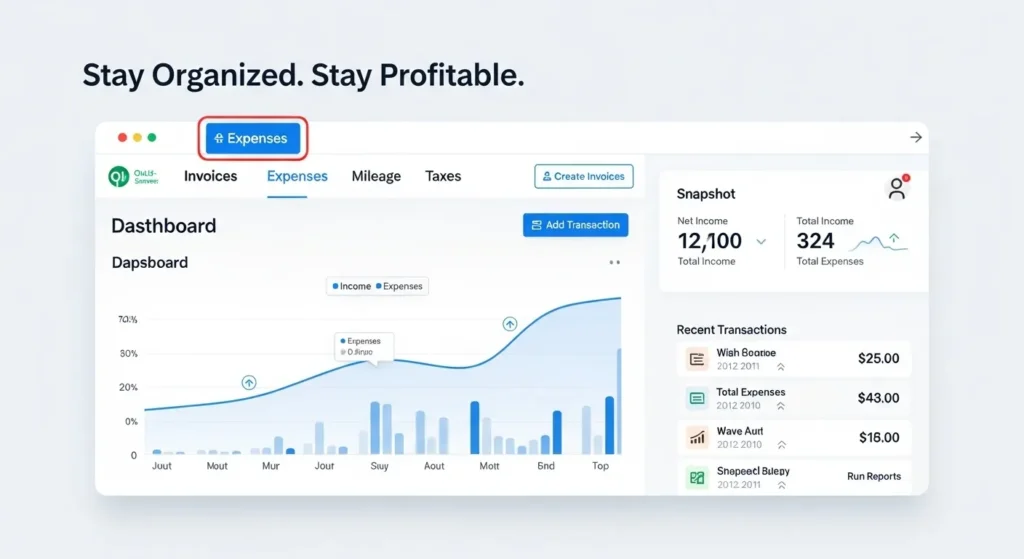

Maximizing Your Experience After Logging In

Your QuickBooks Self Employed Login account unlocks powerful features designed to streamline your financial management. Here’s how to make the most of your logged-in access:

Invoice Creation and Management

- Create professional invoices with custom branding

- Set up recurring invoices for regular clients

- Track payment status in real-time

- Send automatic payment reminders

- Accept multiple payment methods through integrated processing

Smart Transaction Categorization

- Connect your business bank accounts and credit cards

- Auto-categorize transactions for tax deductions

- Split transactions between business and personal use

- Create custom categories for specific business needs

- Add receipt photos directly to transactions

Comprehensive Expense Tracking

- Capture receipts through mobile app scanning

- Set up rules for automatic expense classification

- Generate detailed expense reports

- Track project-specific costs

- Monitor spending patterns through visual dashboards

Mileage Tracking Features

- Auto-track business trips using GPS

- Classify drives as business or personal

- Calculate mileage deductions automatically

- Review trip history with detailed maps

- Export mileage logs for tax purposes

Tax Preparation Tools

- Identify tax-deductible expenses

- Calculate quarterly estimated taxes

- Track profit and loss in real-time

- Generate Schedule C worksheets

- Export financial data for tax filing

The platform’s integrated tools work together to provide accurate financial insights. By utilizing these features consistently, you’ll maintain organized records, maximize tax deductions, and gain clear visibility into your business performance. The mobile app extends these capabilities, allowing you to manage finances on-the-go while ensuring all data syncs seamlessly across devices.

Security Best Practices for QuickBooks Self Employed Login

Protecting your financial data in QuickBooks Self Employed Login requires implementing robust security measures. A secure QuickBooks login starts with creating a strong password that includes:

- Minimum 12 characters

- Mix of uppercase and lowercase letters

- Numbers and special characters

- Unique combinations not used for other accounts

Two-Factor Authentication Setup

Enable two-factor authentication for an additional security layer. This feature sends a verification code to your registered mobile device each time you attempt to log in from an unrecognized device.

Network Security Guidelines

Public Wi-Fi networks pose significant risks when accessing financial accounts:

- Use a Virtual Private Network (VPN) if accessing QuickBooks outside your home

- Avoid logging in at coffee shops, airports, or other public locations

- Connect only through password-protected networks

- Ensure your home Wi-Fi network uses WPA3 encryption

Account Monitoring Best Practices

Regular account activity reviews help detect unauthorized access:

- Check login history in account settings

- Review recent transactions weekly

- Monitor connected devices list

- Set up email notifications for account changes

Device Security Measures

Keep your devices secure with these essential steps:

- Install antivirus software

- Enable automatic system updates

- Lock devices with biometric authentication

- Log out after each QuickBooks session

- Clear browser cache regularly

Remember to update your password every 90 days and never share login credentials with anyone, including QuickBooks support representatives who will never ask for this information.

Conclusion

QuickBooks Self Employed login is your key to efficient financial management. With its powerful features, self-employed professionals can:

- Track expenses accurately

- Create professional invoices

- Automatically track mileage

- Prepare taxes effectively

Don’t let login issues disrupt your business operations. When you face access problems, take immediate action by following the troubleshooting steps in this guide. If the issues persist, the QuickBooks support team is available to help you.

A successful QuickBooks Self Employed login gives you access to tools specifically designed for independent professionals. These tools simplify complex financial tasks, allowing you to:

- Save time

- Minimize accounting mistakes

- Make informed business choices

- Stay compliant with tax regulations

Your financial success relies on consistent access to these vital tools. Use your QuickBooks Self Employed login to establish a solid foundation for your business growth and profitability.

FAQs (Frequently Asked Questions)

What is QuickBooks Self-Employed and why is the login portal important?

QuickBooks Self Employed Login is a financial management tool designed specifically for freelancers and independent contractors. Accessing the QuickBooks Self Employed login portal is essential for effective management of self-employment finances, allowing users to track expenses, mileage, and invoices seamlessly.

What features can I access after logging into QuickBooks Self-Employed?

After logging in, users can utilize key features such as mileage tracking, expense categorization, invoice creation, and viewing 1099 forms. These tools help manage finances efficiently and even include a free account option for tax-related document viewing.

How do I securely log into my QuickBooks Self-Employed account?

To securely log in, first create a QuickBooks Self-Employed account if you haven’t already. Use the correct username and password on supported browsers and devices. Ensure your browser is updated to the latest version and avoid using public Wi-Fi to protect your financial data.

What are common login issues with QuickBooks Self-Employed and how can I troubleshoot them?

Common issues include errors like ‘HTTP Status 400 – Bad Request,’ often caused by browser incompatibility or corrupted cache and cookies. Troubleshooting steps include clearing your browser’s cache and cookies specifically for Intuit domains, disabling interfering extensions like ad blockers temporarily, updating your browser, or trying alternative supported browsers.

When should I contact QuickBooks Customer Care Support for login assistance?

If you experience persistent login failures despite troubleshooting, it’s advisable to contact QuickBooks Customer Care Support. Prepare necessary information beforehand to expedite resolution. Support is available via phone or chat during specified hours and follows strict security protocols to ensure safe account access.

How can I maximize my experience after logging into QuickBooks Self-Employed?

Once logged in, you can efficiently create and send invoices, categorize bank transactions for accurate tax filing and bookkeeping, track mileage and expenses within the platform, all contributing to comprehensive financial management tailored for self-employed individuals.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.