Intuit QuickBooks is a leading financial software solution that has transformed the way small businesses handle their finances. With millions of users globally, this all-in-one platform offers a wide range of tools designed to simplify accounting tasks and improve overall business productivity.

The software’s popularity can be attributed to its flexible features:

- Automated Accounting: Simplifies bookkeeping tasks through intelligent automation

- Financial Tracking: Monitors income, expenses, and cash flow in real-time

- Tax Management: Streamlines tax preparation with built-in calculation tools

- Payroll Processing: Handles employee payments and tax withholdings

- Invoice Generation: Creates professional invoices and tracks payments

- Bank Integration: Connects directly with financial institutions for seamless transactions

QuickBooks offers different versions to cater to various business requirements, including cloud-based options that allow access from any location. Its user-friendly interface makes complex financial tasks easy for business owners, regardless of their accounting knowledge.

Small businesses especially benefit from Intuit QuickBooks’ ability to:

- Reduce manual data entry

- Minimize accounting errors

- Generate instant financial reports

- Track business performance

- Maintain tax compliance

- Manage vendor relationships

This powerful financial software continues to evolve, incorporating new features and technologies to support growing businesses in an increasingly digital economy.

Understanding Intuit QuickBooks

Small business success depends on effective financial management. Reliable accounting software is essential for modern business operations, making complex financial tasks easier to handle. Intuit QuickBooks is leading the way in this digital transformation, providing a comprehensive solution that can adapt to various business needs.

Essential Financial Management Components:

- Real-time cash flow monitoring

- Automated transaction categorization

- Instant financial status updates

- Multi-user collaboration capabilities

- Customizable reporting tools

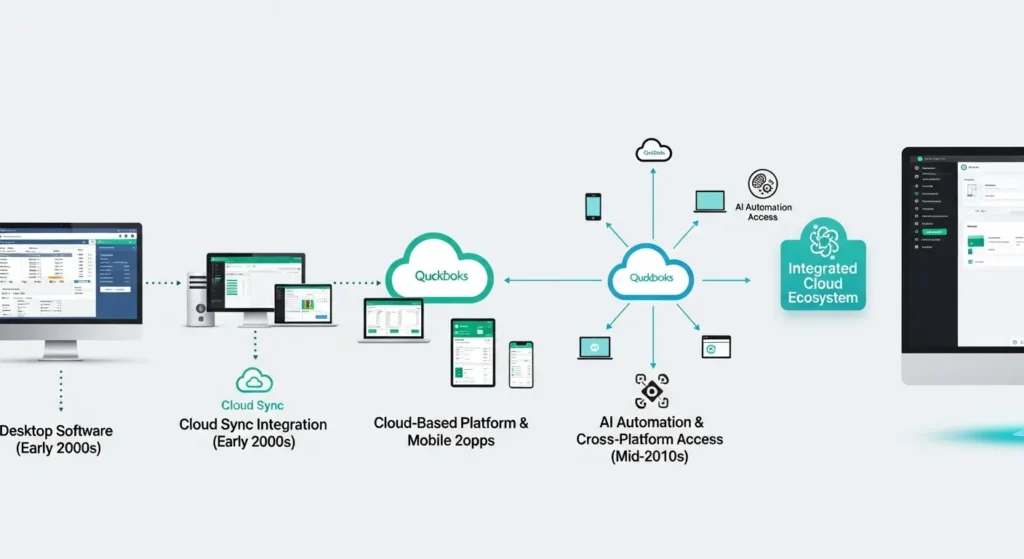

The evolution of Intuit QuickBooks reflects the changing landscape of business operations. From its initial launch as basic accounting software, QuickBooks has transformed into a sophisticated financial management platform. Each version introduces improved features designed to tackle new business challenges.

Key Evolutionary Milestones:

- Integration of cloud technology for remote access

- Mobile app development for on-the-go management

- AI-powered automation for routine tasks

- Enhanced security protocols

- Cross-platform compatibility

QuickBooks’ adaptability goes beyond basic accounting functions. The software now includes industry-specific features tailored to various business sectors:

- Retail: Inventory management and point-of-sale integration

- Service-based: Time tracking and project costing

- Manufacturing: Production cost analysis

- E-commerce: Online sales tracking and marketplace integration

- Professional Services: Client billing and expense allocation

The platform’s commitment to innovation is evident in its regular updates and feature enhancements. These improvements are based on direct user feedback and changing market demands, ensuring the software remains relevant and efficient for modern businesses.

Small businesses benefit from QuickBooks’ scalable architecture, which grows alongside their operations. The software’s ability to handle increasing transaction volumes, multiple users, and complex financial scenarios makes it a sustainable solution for expanding enterprises.

Key Features of Intuit QuickBooks

QuickBooks offers a robust set of features designed to simplify financial management for businesses of all sizes. Let’s explore the core functionalities that make this software indispensable for modern business operations.

Invoicing System

The invoicing capabilities in Intuit QuickBooks transform time-consuming billing processes into streamlined operations:

- Customizable Templates – Create professional invoices with your company logo and branding

- Automated Recurring Invoices – Set up automatic billing for regular clients

- Multi-Currency Support – Send invoices in different currencies for international transactions

- Real-Time Tracking – Monitor payment status and send automatic reminders

Expense Tracking

QuickBooks’ expense tracking system helps businesses maintain precise financial records:

- Receipt Capture – Snap photos of receipts using the mobile app

- Expense Categorization – Automatically sort expenses into appropriate categories

- Mileage Tracking – Record business travel expenses with GPS tracking

- Budget Management – Create and monitor expense budgets in real-time

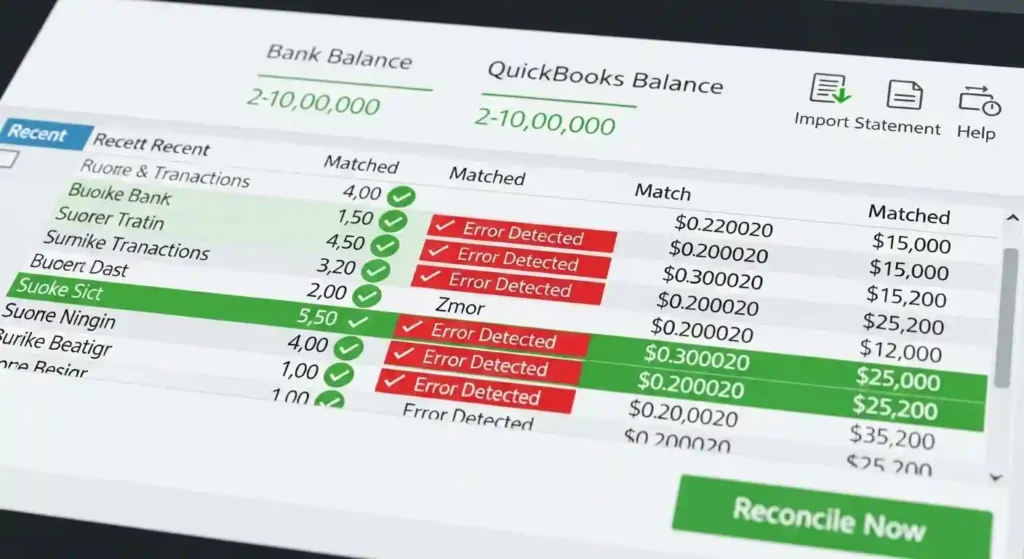

Bank Reconciliation

The bank reconciliation feature serves as a powerful tool for maintaining accurate financial records:

Key Benefits:

- Automatic transaction matching

- Error detection and correction

- Prevention of duplicate entries

- Real-time account balance updates

Advanced Reconciliation Tools:

- Bank feed integration

- Transaction categorization

- Statement import capabilities

- Discrepancy alerts

The software automatically flags potential issues such as:

- Missing transactions

- Duplicate entries

- Unmatched payments

- Unexpected charges

QuickBooks’ bank reconciliation process reduces manual data entry by importing transactions directly from connected bank accounts. This automation minimizes human error while providing a clear audit trail for all financial activities.

The platform’s smart matching algorithm identifies and categorizes transactions based on previous patterns, learning from user corrections to improve accuracy over time. Users can review suggested matches and approve or modify them as needed, maintaining full control while benefiting from automated assistance.

Simplifying Tax Preparation with QuickBooks

QuickBooks makes tax season easier with its powerful tools for preparing taxes. The software automatically organizes transactions and keeps track of expenses that can be deducted throughout the year, making it easier to file taxes accurately.

Key Features for Preparing Taxes:

1. Automated Tax Calculations

- Real-time tracking of sales tax

- Automatic computation of payroll taxes

- Built-in tax rate tables for different jurisdictions

2. Tax Report Generation

- Profit and Loss statements

- Balance sheets

- Detailed expense reports

- Custom tax reports based on specific requirements

In addition to basic calculations, Intuit QuickBooks also keeps detailed records of:

- Business expenses

- Income transactions

- Asset depreciation

- Vendor payments

- Employee-related tax documents

Reducing Errors and Saving Time

By using automated data entry and calculations, Intuit QuickBooks’ tools for preparing taxes help minimize human errors. The software also highlights potential discrepancies and unusual patterns, allowing users to identify and fix problems before submitting their tax returns.

Time-Saving Benefits:

- Direct export of tax data to popular tax filing software

- Automatic generation of 1099 forms for contractors

- Year-round expense tracking for tax purposes

- Digital receipt storage and organization

Small business owners can easily access financial statements that are ready for taxes with just one click. These reports provide important information for tax professionals, making collaboration more efficient and productive.

Staying on Top of Tax Obligations

The tax tracking features in Intuit QuickBooks help businesses:

- Identify potential tax deductions

- Monitor quarterly tax obligations

- Plan for estimated tax payments

- Maintain documentation that is ready for audits

Seamless Integration with TurboTax

QuickBooks’ integration with TurboTax creates a smooth connection between accounting records and tax filing. Users can directly transfer their financial data to their tax returns, eliminating the need for manual data entry and reducing the chances of transcription errors.

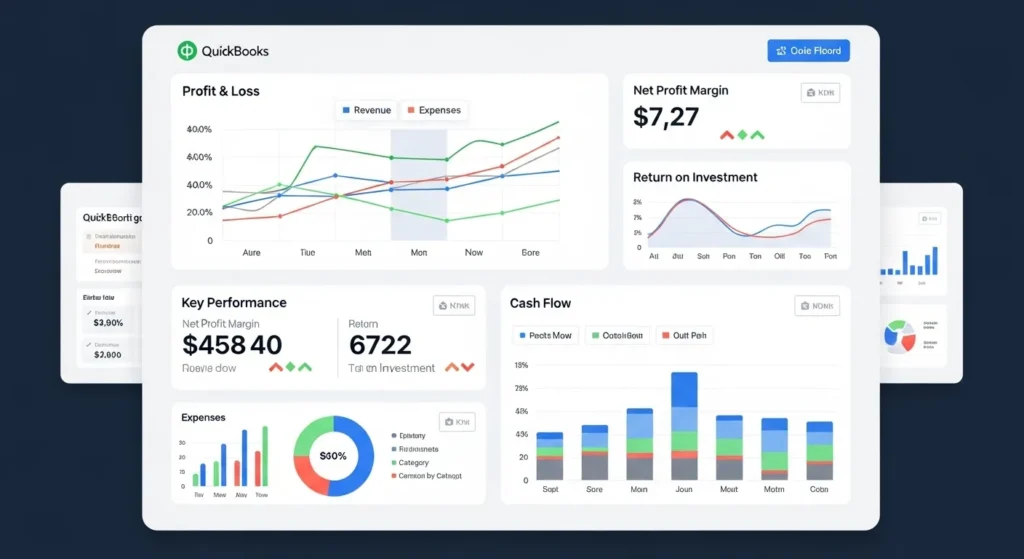

Generating Detailed Financial Reports Using Intuit QuickBooks

QuickBooks’ powerful financial reporting features enable business owners to make informed decisions based on a thorough understanding of their company’s financial situation. The platform provides a wide variety of customizable reports that turn basic financial information into valuable insights.

Essential Financial Reports in Intuit QuickBooks:

1. Balance Sheet Reports

- Track assets, liabilities, and equity

- Monitor financial position in real-time

- Compare historical data across multiple periods

2. Profit and Loss Statements

- Analyze revenue streams and expenses

- Break down costs by department or project

- Identify seasonal trends and patterns

3. Cash Flow Reports

- Track money movement in and out of accounts

- Predict future cash positions

- Manage working capital effectively

Customizing Reports in Intuit QuickBooks

Intuit QuickBooks allows users to tailor these reports using various filters and parameters:

- Date ranges for specific time periods

- Customer segments or classes

- Product categories

- Payment methods

- Location-based data

Advanced Reporting Features

The platform offers advanced reporting capabilities such as:

Automated Report Generation

- Schedule regular report delivery

- Export data in multiple formats

- Share reports with stakeholders

Custom Report Builder

- Create tailored reports for specific needs

- Add or remove columns

- Adjust formatting and layout

- Save custom report templates

- Convert data into charts and graphs

- Color-coded performance indicators

- Interactive dashboards

Benefits of Using QuickBooks Reporting Tools

Business owners can utilize these reporting features to:

- Identify spending patterns

- Track budget variances

- Monitor key performance indicators (KPIs)

- Analyze revenue trends

- Assess profitability by product or service

Seamless Integration with Other Intuit QuickBooks Features

The reporting system works smoothly with other Intuit QuickBooks functionalities, retrieving real-time information from:

- Sales transactions

- Expense records

- Inventory management

- Payroll information

- Tax calculations

Collaboration and Security with Multi-User Access

QuickBooks’ reporting capabilities allow multiple users to access the system with different permission levels based on their roles. This promotes teamwork while ensuring data security.

Users can set up automated notifications for specific financial thresholds or metrics, enabling proactive management of business finances.

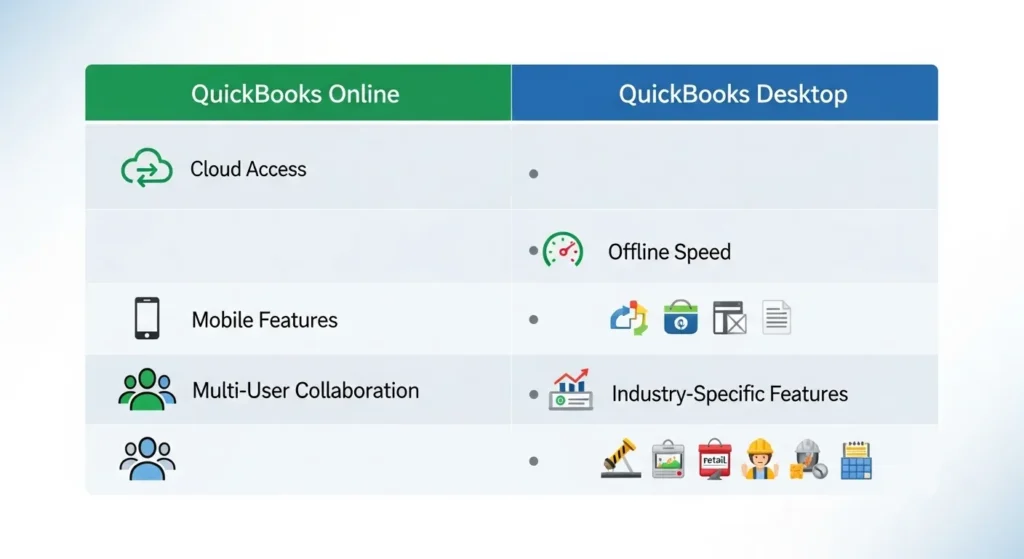

Exploring Different Versions of QuickBooks

QuickBooks offers distinct versions tailored to diverse business needs, with QuickBooks Online and QuickBooks Desktop standing as the primary options. Each version brings unique capabilities and features to the table.

Advantages of Intuit QuickBooks Online:

- Access from any device with internet connection

- Real-time data synchronization across devices

- Automatic updates and backups

- Multi-user collaboration from different locations

- Integration with third-party apps

- Subscription-based pricing model

Advantages of Intuit QuickBooks Desktop:

- One-time purchase option

- Faster processing for large data files

- Advanced inventory management

- Industry-specific features

- Local data storage control

- Batch invoicing capabilities

The cloud-based QuickBooks Online excels in remote work scenarios, allowing team members to access financial data simultaneously from different locations. Business owners can review reports, approve expenses, and manage finances while traveling, making it ideal for companies with distributed teams.

QuickBooks Desktop provides robust features for businesses requiring complex inventory tracking and industry-specific solutions. Its local installation offers enhanced speed when processing large amounts of data, beneficial for companies with extensive transaction volumes.

Remote Access and Collaboration Features:

- Real-time updates for all users

- Custom user permission settings

- Automated bank feeds

- Mobile receipt capture

- Simultaneous multi-user access

- Secure data sharing with accountants

The choice between online and desktop versions depends on specific business requirements, such as:

- Number of users needed

- Internet connectivity reliability

- Data storage preferences

- Industry-specific feature requirements

- Budget constraints

- Growth projections

Both versions maintain the core QuickBooks functionality while offering distinct advantages for different business models and operational needs.

Choosing the Right Version Based on Business Size and Needs

Selecting the ideal QuickBooks version requires careful consideration of your business structure and operational requirements. Here’s a breakdown of QuickBooks versions tailored to specific business needs:

QuickBooks Self-Employed

- Perfect for freelancers and independent contractors

- Tracks personal and business expenses separately

- Calculates quarterly tax estimates

- Mileage tracking capabilities

QuickBooks Simple Start

- Suited for small businesses with basic accounting needs

- Handles income and expense tracking

- Manages up to 20 customers

- Creates basic financial reports

QuickBooks Essentials

- Designed for growing small businesses

- Supports multiple users (up to 3)

- Includes bill management features

- Advanced reporting capabilities

QuickBooks Plus

- Built for established small to medium businesses

- Inventory tracking and management

- Project profitability tracking

- Supports up to 5 users

QuickBooks Advanced

- Engineered for larger businesses and corporations

- Custom user permissions

- Business analytics and insights

- Handles complex business operations

- Supports up to 25 users

Each version scales up in functionality and complexity, allowing businesses to choose based on their current size while considering future growth potential. The pricing structure reflects these increasing capabilities, making it essential to balance immediate needs against long-term business objectives.

Managing Payments Efficiently with QuickBooks Payments

QuickBooks Payments transforms the way businesses handle transactions by integrating payment processing directly into their accounting workflow. This built-in payment solution eliminates the need for separate payment processing systems, creating a seamless financial management experience.

Key Payment Processing Features:

- Instant Invoice Payments – Customers receive professional invoices with embedded payment buttons

- Real-Time Transaction Recording – Payments automatically sync with your books

- Mobile Payment Acceptance – Process payments anywhere using the QuickBooks mobile app

- Recurring Payment Setup – Automate regular billing cycles for subscription-based services

The platform supports diverse payment methods to accommodate customer preferences:

- Credit and Debit Cards: Visa, Mastercard, American Express, Discover

- Digital Payment Options: ACH bank transfers, Apple Pay, Free bank transfers (ACH)

Payment Processing Rates

Card-Present Transactions: 2.4% + $0.25

Card-Not-Present Transactions: 2.9% + $0.25

ACH Bank Transfers: 1% (max $10)

QuickBooks Payments includes built-in fraud protection and security measures to safeguard transactions. The system automatically flags suspicious activities and provides detailed transaction reports for monitoring payment patterns.

Business Benefits:

- Reduced manual data entry

- Faster payment collection

- Improved cash flow management

- Professional payment experience for customers

- Automated payment reconciliation

- Real-time payment status tracking

The integration with QuickBooks accounting features enables businesses to track payments, manage customer information, and generate financial reports from a single platform. This streamlined approach reduces errors and saves valuable time in payment processing operations.

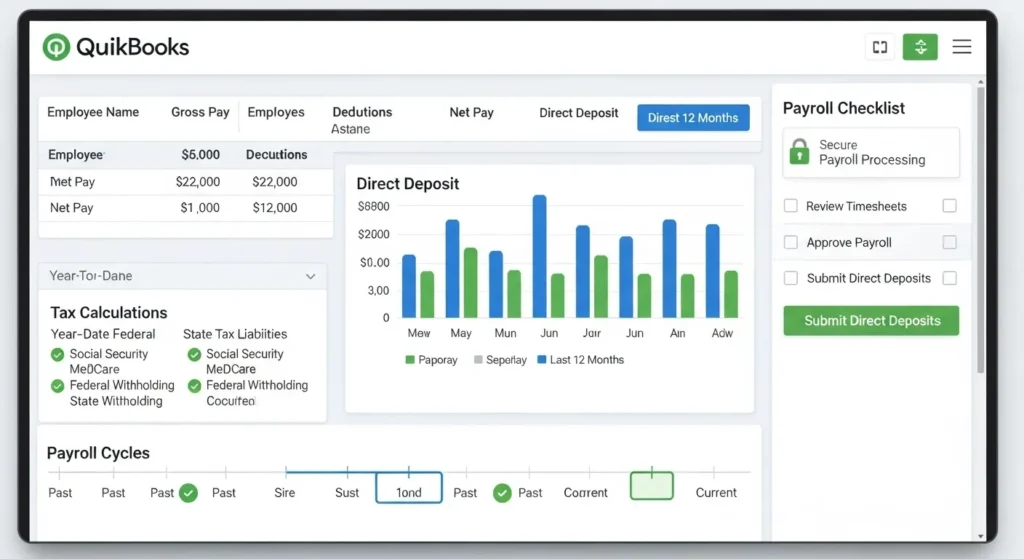

Streamlining Payroll Management Using QuickBooks

QuickBooks payroll services transform complex payroll processes into streamlined operations for small businesses. The integrated payroll system handles crucial tasks automatically, reducing manual work and potential errors.

Key Payroll Functions:

- Automated Tax Calculations: Federal, state, and local tax computations, real-time tax table updates, automatic tax form generation (W-2s, 1099s), and tax liability tracking.

- Direct Deposit Management: Same-day or next-day direct deposits, multiple bank account support, employee payment scheduling, and direct deposit status tracking.

- Employee Information Management: Digital employee records, time tracking integration, benefits administration, and vacation and sick leave tracking.

Advanced Payroll Features:

- Automatic payroll runs based on preset schedules

- Custom deduction calculations

- Multi-state payroll processing

- Workers’ compensation tracking

- Garnishment payment processing

The system’s smart automation handles complex calculations instantly. When employees work overtime or receive bonuses, QuickBooks adjusts tax withholdings and deductions accordingly. Small business owners save valuable time by eliminating manual computations and reducing the risk of costly errors.

Compliance and Reporting:

- Automated tax form filing

- State and federal compliance updates

- Digital signature capabilities

- Detailed payroll reports

- Year-end processing assistance

QuickBooks payroll services include built-in safeguards to prevent common payroll mistakes. The system flags potential errors and provides alerts for missing information or unusual changes in payroll data.

Employee Self-Service Features:

- Online pay stub access

- W-2 form downloads

- Personal information updates

- Time-off requests

- Benefits information viewing

Small businesses gain particular value from the integrated time tracking capabilities. The system syncs with popular time tracking apps, automatically calculating regular and overtime hours. This integration eliminates double data entry and ensures accurate payment processing.

The payroll dashboard provides real-time insights into labor costs, helping businesses make informed staffing decisions. Users can generate detailed reports on payroll expenses, tax liabilities, and labor distribution across departments or projects.

Ensuring Data Security and Protection in Intuit QuickBooks

Data security is a critical priority in financial management software. Intuit QuickBooks implements robust security measures to protect sensitive business information, financial records, and customer data.

Advanced Encryption Standards

- Bank-level 256-bit encryption for all data transmission

- Secure Socket Layer (SSL) technology for protected connections

- Multi-factor authentication protocols

- Automatic session timeouts after periods of inactivity

Cloud Storage Protection

- Multiple server locations with redundant backups

- Physical security measures at data centers

- Regular security audits and compliance checks

- Automated threat detection systems

User Access Controls

- Customizable permission settings for different team members

- Activity tracking and audit logs

- Secure password policies

- IP address tracking and suspicious activity alerts

Data Protection Features

- Automatic data backup every hour

- Point-in-time recovery options

- Disaster recovery protocols

- Regular system updates and security patches

QuickBooks maintains compliance with industry standards including:

- PCI DSS for payment processing

- SOC 1 and SOC 2 certifications

- GDPR compliance for European users

- HIPAA compliance capabilities

The platform’s security infrastructure includes dedicated teams monitoring potential threats 24/7. These specialists work to identify vulnerabilities, implement preventive measures, and respond to emerging security challenges.

Small businesses benefit from enterprise-grade security features without additional investment in security infrastructure. QuickBooks automatically applies security updates and patches, ensuring users always operate with the latest protection measures.

The system’s automated backup features protect against data loss from hardware failures, natural disasters, or cyber incidents. Users can restore their data to specific points in time, maintaining business continuity during unexpected events.

Customer Support Options Available for QuickBooks Users

QuickBooks users have access to a wide range of support options through various channels, all designed to help with different technical problems and questions. The customer service system of the platform includes:

Direct Support Channels:

- 24/7 phone assistance with dedicated support teams

- Live chat support through the QuickBooks website

- Email ticketing system for non-urgent inquiries

- Screen sharing capabilities for complex troubleshooting

Self-Help Resources:

- Extensive knowledge base with step-by-step guides

- Video tutorials covering common features and processes

- Community forums where users share solutions

- Interactive training webinars

Premium Support Options:

- Priority Circle membership for personalized assistance

- QuickBooks ProAdvisor network access

- Advanced technical support for enterprise users

- Dedicated account managers for large businesses

The QuickBooks Learn & Support Center is the main place where users can find these resources. In this center, users can search through different topics, look at frequently asked questions, or directly get in touch with support representatives. There is also an AI-powered chatbot on the platform that can give immediate answers to simple questions, guide users to relevant documents, or pass on complicated problems to human agents when needed.

QuickBooks is also active on social media platforms such as Twitter and Facebook, providing additional ways for users to receive updates and support.

Advantages of Choosing Intuit QuickBooks for Small Businesses

Small businesses gain significant financial advantages by choosing Intuit QuickBooks as their accounting solution. The software delivers professional-grade financial management at a fraction of the cost of hiring a full-time accountant.

Cost-Effective Financial Management

- Annual Intuit QuickBooks subscription costs range from $25 to $150 per month

- Traditional accounting services can cost $1,000-$5,000+ monthly

- Built-in automation reduces the need for additional staff

- No extra costs for software updates and maintenance

Growth-Enabling Features

- Real-time cash flow monitoring helps make informed business decisions

- Automated invoice reminders improve collection rates

- Integration with 650+ business apps maximizes efficiency

- Mobile access enables managing finances from anywhere

Time-Saving Benefits

- Automated data entry reduces manual bookkeeping hours

- Bank feeds automatically categorize transactions

- Built-in tax calculations streamline tax preparation

- Instant financial reports eliminate manual report creation

QuickBooks transforms small business financial management through its comprehensive digital toolset. The platform’s ability to automate routine tasks while providing deep financial insights creates a solid foundation for business growth. Small business owners can focus on core operations while maintaining professional-grade financial management practices through Intuit QuickBooks’ intuitive interface and robust feature set.

The combination of affordable pricing, powerful automation, and scalable features makes Intuit QuickBooks an invaluable asset for small businesses aiming to establish strong financial practices and achieve sustainable growth.

FAQs (Frequently Asked Questions)

What is Intuit QuickBooks and why is it popular among small businesses?

Intuit QuickBooks is a leading financial software solution designed specifically for small businesses. It offers key features such as invoicing, expense tracking, bank reconciliation, and payroll management that streamline financial processes, making it popular among users for its reliability and ease of use.

How has Intuit QuickBooks evolved to meet the changing needs of businesses?

Over the years, Intuit QuickBooks has continuously evolved by adding new features like cloud-based solutions, automated tax preparation tools, and integrated payment processing. These enhancements help businesses manage finances more effectively and adapt to modern accounting requirements.

What are the core features of Intuit QuickBooks that help streamline financial management?

Core features of Intuit QuickBooks include invoicing, expense tracking, bank reconciliation, tax preparation tools, payroll services, and payment processing integration. These functionalities ensure accurate record-keeping, simplify tax filing, and enable efficient payment management for small businesses.

How does Intuit QuickBooks simplify tax preparation for small businesses?

QuickBooks offers automated tax calculation features and generates comprehensive tax reports that save time and reduce errors during tax filing. These tools help small businesses stay compliant with tax regulations while minimizing the risk of costly mistakes.

What are the differences between Intuit QuickBooks Online and desktop versions?

QuickBooks Online is a cloud-based solution offering remote access and collaboration capabilities, making it ideal for businesses needing flexibility. In contrast, the desktop version provides robust offline functionality suitable for users preferring local software installation. Choosing between them depends on business size, needs, and preference for cloud accessibility.

How does Intuit QuickBooks ensure data security and protect sensitive financial information?

Intuit QuickBooks implements strong data security measures including encryption protocols and secure cloud storage to safeguard sensitive financial information. These protections are crucial for maintaining confidentiality and trust when managing accounting data through their software.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.