The QuickBooks Card Reader is changing the way businesses handle in-person payments. This small device allows merchants to accept credit and debit card transactions directly through their QuickBooks system.

As a dedicated payment processing solution, the QuickBooks Card Reader addresses critical business needs:

- Simplified Payment Collection: Accept payments anywhere your business operates

- Real-time Transaction Recording: Instant sync with your QuickBooks accounting software

- Professional Customer Experience: Present a polished image with modern payment options

The device connects seamlessly to your existing technology through multiple methods:

- Bluetooth connectivity for wireless operation

- USB connection for stable desktop setup

- Direct integration with QuickBooks mobile apps

You can use the QuickBooks Card Reader with various compatible devices:

- iPhones and iPads

- Android smartphones and tablets

- Desktop computers running QuickBooks software

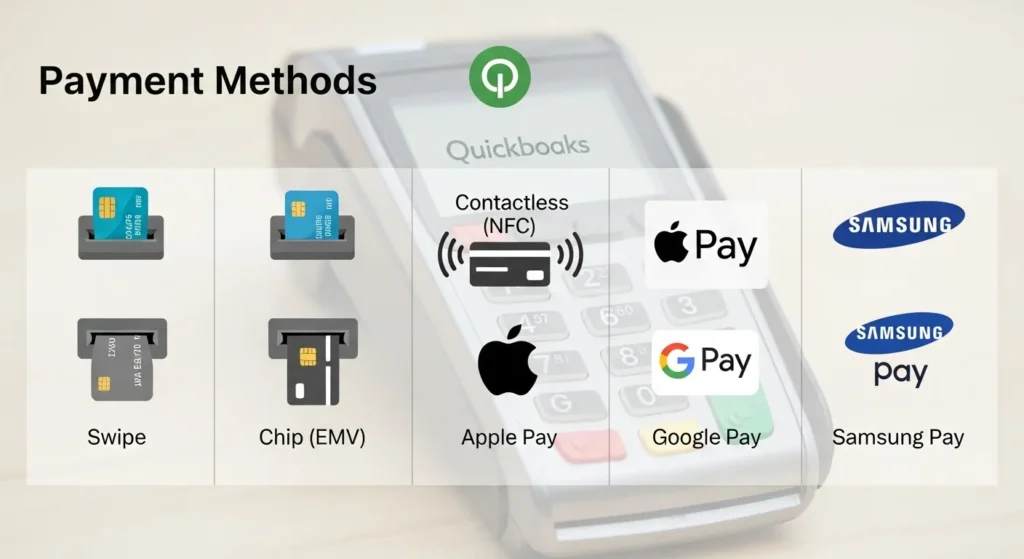

The latest models support diverse payment methods:

- Traditional card swipes

- EMV chip cards

- Contactless payments

- Digital wallets (Apple Pay, Google Pay)

- NFC-enabled cards

This versatile payment tool helps businesses stay competitive in an increasingly cashless marketplace. Small business owners, freelancers, and service providers can process payments efficiently while maintaining professional financial records.

Key Features of QuickBooks Card Reader

QuickBooks Card Reader stands out with its comprehensive set of features designed to streamline payment processing for businesses of all sizes. Let’s explore the essential capabilities that make this payment solution indispensable for modern businesses.

Acceptance of Multiple Payment Types

The QuickBooks Card Reader supports a diverse range of payment methods:

- Traditional Card Payments: Magnetic stripe cards, EMV chip cards, and PIN-based debit transactions

- Contactless Solutions: NFC-enabled cards, Apple Pay, Google Pay, Samsung Pay, and other digital wallets

This versatility enables businesses to accommodate customer preferences and stay competitive in today’s digital marketplace. The ability to accept various payment methods reduces transaction friction and helps prevent lost sales due to payment limitations.

Smart Payment Processing

The card reader’s intelligent features enhance the payment experience:

- Quick Transaction Speed: 2-3 second processing time for contactless payments, under 10 seconds for chip card transactions, and instant confirmation notifications

- Offline Mode: Continues processing payments during internet outages, automatically syncs transactions when connection resumes, and secure data storage during offline operations

These features ensure that businesses can provide efficient service even in challenging connectivity situations.

Advanced Security Measures

QuickBooks Card Reader incorporates robust security protocols:

- End-to-end encryption for all transactions

- EMV-compliant security standards

- Tokenization of sensitive data

- Real-time fraud detection

- PCI DSS compliance

These security features protect both businesses and customers from potential fraud while maintaining transaction efficiency. The system automatically updates security protocols to address emerging threats and comply with new regulations.

User-Friendly Interface

The card reader’s design prioritizes ease of use:

- Clear Display: Transaction amount verification, payment status indicators, and battery level monitoring

- Audio-Visual Cues: LED indicators for successful transactions, error notification sounds, and connection status alerts

The intuitive interface reduces training time for staff and minimizes transaction errors, creating a smoother payment experience for both employees and customers.

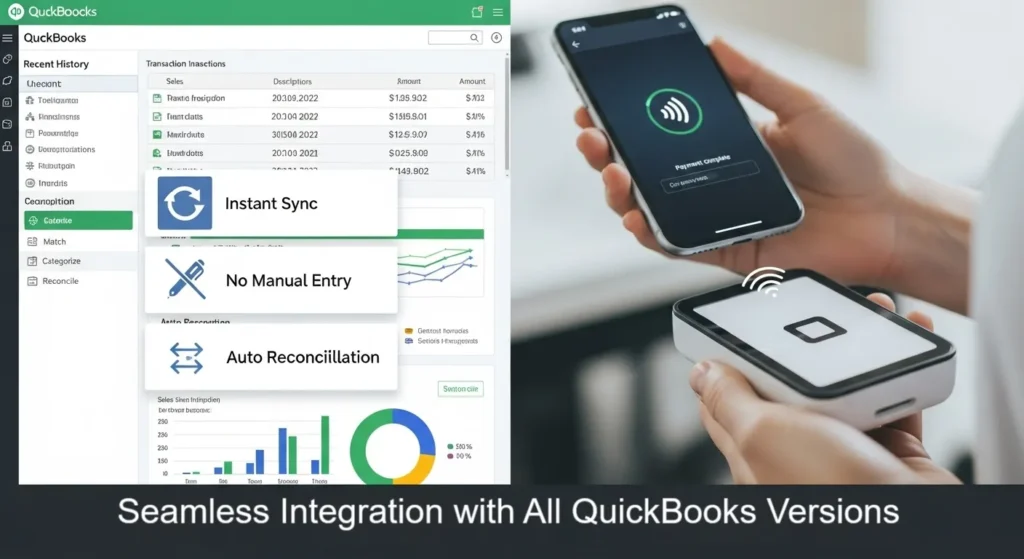

Integration with QuickBooks Software

QuickBooks Card Reader transforms your payment processing into a seamless accounting experience through direct integration with QuickBooks software. The system automatically records transactions, updates your books, and maintains accurate financial records without manual data entry.

Real-Time Synchronization Benefits:

- Instant transaction recording in your QuickBooks account

- Automatic categorization of sales and payments

- Elimination of double-entry errors

- Time savings through automated reconciliation

- Detailed transaction history tracking

The integration supports multiple QuickBooks versions, including:

- QuickBooks Online

- QuickBooks Desktop Pro

- QuickBooks Desktop Premier

- QuickBooks Enterprise Solutions

Your card reader connects directly to the QuickBooks ecosystem through the GoPayment app or QuickBooks mobile app. This connection enables real-time data flow between your point of sale and accounting software, creating a unified system for managing your business finances.

Smart Features for Business Management:

- Custom receipt creation with your business logo

- Automatic sales tax calculation

- Inventory tracking updates

- Customer profile management

- Employee sales tracking

The system maintains compatibility across software updates, ensuring your payment processing remains uninterrupted. You can process payments confidently, knowing your financial data syncs accurately with your QuickBooks account, regardless of which version you use.

For businesses managing multiple locations, the integration allows centralized tracking of all transactions while maintaining separate records for each location. This feature provides clear visibility into your business performance across different sites.

Various Models Available in the Market

QuickBooks offers three distinct card reader models to match different business requirements:

1. QuickBooks Card Reader (Latest Model)

- Sleek, compact design for maximum portability

- Accepts chip, tap, and swipe payments

- Built-in display for transaction status

- Extended battery life up to 8 hours

- Ideal for mobile businesses and service providers

2. QuickBooks GoPayment Chip and Magstripe Reader

- Budget-friendly option for basic payment processing

- Handles chip cards and magnetic stripe payments

- Compact size fits easily in pocket

- Perfect for small businesses with lower transaction volumes

- Recommended for startups and solo entrepreneurs

3. QuickBooks GoPayment All-in-One Reader

- Premium model with advanced features

- Processes all payment types including:

- EMV chip cards

- Contactless payments

- Digital wallets

- Traditional swipe transactions

- Includes charging dock for stationary use

- Best suited for:

- Retail stores

- Restaurants

- High-volume businesses

- Multi-employee operations

Each model connects seamlessly via Bluetooth to iOS and Android devices, enabling businesses to choose the reader that aligns with their specific needs. The selection criteria often depends on factors like transaction volume, payment types accepted, and mobility requirements.

Small businesses processing occasional payments might find the basic Chip and Magstripe Reader sufficient, while growing enterprises benefit from the versatility of the All-in-One Reader. Mobile service providers typically prefer the latest QuickBooks Card Reader for its portable design and comprehensive payment acceptance capabilities.

Security and Privacy Features in QuickBooks Card Reader

QuickBooks Card Reader implements robust security measures to protect both businesses and their customers during payment transactions. The device uses advanced encryption technology to safeguard sensitive data from potential threats.

Key Security Features:

- End-to-end encryption for all transactions

- Zero card number storage on the device

- EMV chip technology compliance

- PCI DSS certification

- Secure Bluetooth connectivity

The card reader’s built-in security protocol prevents the recording of card numbers during transactions. This feature eliminates the risk of card data being compromised through skimming devices or malicious software.

Employee Access Controls:

- Custom permission settings

- Limited access to sensitive data

- Transaction tracking by user

- Secure login requirements

Your employees can process payments without accessing sensitive customer information. The system restricts visibility to essential transaction details while maintaining comprehensive security measures.

Customer Data Protection:

- Tokenization of payment information

- Secure cloud storage

- Automated data backup

- Regular security updates

The QuickBooks Card Reader maintains strict compliance with industry security standards. Each transaction undergoes multiple layers of verification to prevent unauthorized access and ensure data integrity.

Real-time Monitoring:

- Instant fraud detection

- Suspicious activity alerts

- Transaction verification systems

- Automated security checks

These security features create a protected environment for payment processing, building trust between businesses and their customers while maintaining the highest standards of data protection.

Additional Features and Innovations in Payment Technology

QuickBooks Card Reader embraces cutting-edge payment technology through its Tap to Pay on iPhone feature. This innovative solution enables businesses to accept contactless payments directly through their iPhone, eliminating the need for additional hardware.

Key Contactless Payment Features:

- NFC-enabled transactions

- Digital wallet compatibility (Apple Pay, Google Pay)

- Instant payment processing

- Real-time transaction verification

The integration of contactless payment options brings substantial benefits to businesses:

- Speed: Transactions complete in seconds

- Hygiene: Reduced physical contact during payments

- Customer Preference: Meeting modern payment expectations

- Reduced Equipment Costs: Less hardware maintenance

The QuickBooks Card Reader’s mobile device integration creates a seamless payment experience through:

- Bluetooth connectivity for stable connections

- Auto-reconnect features

- Battery optimization

- Quick-launch payment processing

These technological advancements enhance customer satisfaction by:

- Reducing wait times at checkout

- Providing digital receipts instantly

- Enabling flexible payment options

- Supporting multi-currency transactions

The card reader’s smart technology includes built-in features like:

- Transaction amount verification

- Automatic tip calculations

- Custom payment fields

- Digital signature capture

Small businesses benefit from these innovations through improved cash flow management, reduced transaction times, and enhanced customer service capabilities. The QuickBooks Card Reader’s technological features position businesses to meet evolving consumer payment preferences while maintaining efficient operations.

Common User Inquiries and Clarifications Regarding Usage Scenarios for QuickBooks Card Reader

Many businesses ask about the differences between traditional magstripe readers and the QuickBooks Card Reader. Here’s what you need to know:

Traditional Magstripe Readers:

- Connect directly to desktop computers via USB

- Limited to basic card swipe functionality

- Primarily used for manual invoice processing

- Require separate data entry into accounting systems

- Work independently of mobile devices

QuickBooks Card Reader Features:

- Bluetooth connectivity for mobile devices

- Multiple payment acceptance methods (chip, tap, swipe)

- Real-time transaction processing

- Automatic synchronization with QuickBooks software

- Built-in security protocols

The QuickBooks Card Reader shines in specific business scenarios:

Ideal Use Cases:

- Retail stores requiring point-of-sale mobility

- Service providers who need on-site payment processing

- Businesses with multiple payment collection points

- Companies seeking integrated accounting solutions

- Mobile vendors and pop-up shops

Your business type determines the most effective payment solution. The QuickBooks Card Reader serves businesses needing immediate, mobile payment processing with automatic accounting integration. Traditional magstripe readers suit operations focused on desktop-based invoice processing with manual data entry workflows.

The choice between these solutions impacts your:

- Payment processing speed

- Data accuracy

- Customer payment options

- Staff training requirements

- Accounting workflow efficiency

Conclusion

The QuickBooks Card Reader is a powerful tool for businesses looking to modernize their payment processing systems. It transforms how companies handle transactions, creating a seamless connection between accepting payments and managing finances.

Key Benefits for Your Business:

- Direct integration with QuickBooks software eliminates manual data entry

- Real-time transaction syncing keeps your books accurate and up-to-date

- Multiple payment options enhance customer satisfaction

- Built-in security features protect sensitive financial data

- Mobile compatibility enables payments anywhere, anytime

The QuickBooks Card Reader’s versatility makes it an ideal choice for businesses of all sizes. Small retailers benefit from its user-friendly interface, while larger operations appreciate its robust reporting capabilities. The device’s ability to accept various payment methods – from traditional cards to digital wallets – positions your business to meet evolving customer preferences.

By choosing the QuickBooks Card Reader, you’re not just selecting a payment processing tool – you’re investing in a comprehensive solution that streamlines your entire financial workflow. This integration between payment processing and accounting systems creates efficiency, reduces errors, and gives you more time to focus on growing your business.

The future of payment processing lies in integrated solutions, and the QuickBooks Card Reader delivers this seamless experience while maintaining the security and reliability your business demands.

FAQs (Frequently Asked Questions)

What payment types does the QuickBooks Card Reader accept?

The QuickBooks Card Reader accepts multiple payment types including swipe, chip (EMV), tap (contactless payments), Apple Pay, and various digital wallets, providing customer convenience and flexibility.

How does the QuickBooks Card Reader integrate with QuickBooks software?

QuickBooks Card Reader seamlessly integrates with QuickBooks software to sync sales data automatically, keep books up-to-date, and streamline accounting processes, ensuring compatibility with different versions of QuickBooks.

What security features are implemented in the QuickBooks Card Reader?

The QuickBooks Card Reader ensures secure transactions by preventing card number recording during transactions and processing payments without accessing sensitive customer data, thereby protecting customer information and enhancing trust.

Are there different models of the QuickBooks Card Reader available?

Yes, various models of the QuickBooks Card Reader are available in the market, each offering different features and functionalities tailored for specific business needs such as small businesses, freelancers, or high transaction volumes.

Does the QuickBooks Card Reader support contactless payments on mobile devices?

Yes, the QuickBooks Card Reader supports Tap to Pay on iPhone and contactless payments on mobile devices, improving customer experience through innovative payment technology integration.

How does the QuickBooks Card Reader differ from traditional magstripe readers used for invoicing?

Unlike traditional magstripe readers primarily used for invoicing purposes, the QuickBooks Card Reader offers enhanced functionality including acceptance of multiple payment types, integration with accounting workflows, and advanced security features designed for seamless business payment processing.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.