Choosing the right accounting software is crucial for business success in today’s digital world. Two popular options, Wave and QuickBooks, have different approaches to financial management, each designed to meet specific business needs.

When considering your options, it’s essential to evaluate wave vs quickbooks as both offer unique benefits that cater to different business requirements.

Many users have debated the merits of wave vs quickbooks, often highlighting their contrasting pricing models and features.

Understanding the differences in wave vs quickbooks can help you make an informed decision on which software to choose.

This analysis will take a closer look at the wave vs quickbooks comparison, focusing on their strengths and weaknesses.

Wave positions itself as a free accounting platform, focusing on simplicity. This cloud-based solution is ideal for freelancers and small businesses who require basic financial tools without the intricacies of advanced features. The platform offers essential accounting functions, ranging from simple bookkeeping to easy invoicing.

On the other hand, QuickBooks takes a different route as a comprehensive, paid accounting solution. Developed by Intuit, this powerful platform caters to growing businesses that require advanced financial management tools. It provides detailed reporting, wide-ranging integrations, and scalable features to facilitate business growth.

The decision between Wave and QuickBooks affects:

- Daily financial tasks

- Business growth potential

- Resource allocation

- Time management

- Financial reporting capabilities

This detailed comparison analyzes both platforms based on important factors:

- Core features

- Pricing structures

- User experience

- Integration capabilities

- Support systems

By understanding these factors, businesses can align their choice of accounting software with their operational requirements, growth objectives, and budget limitations.

Wave Accounting Software

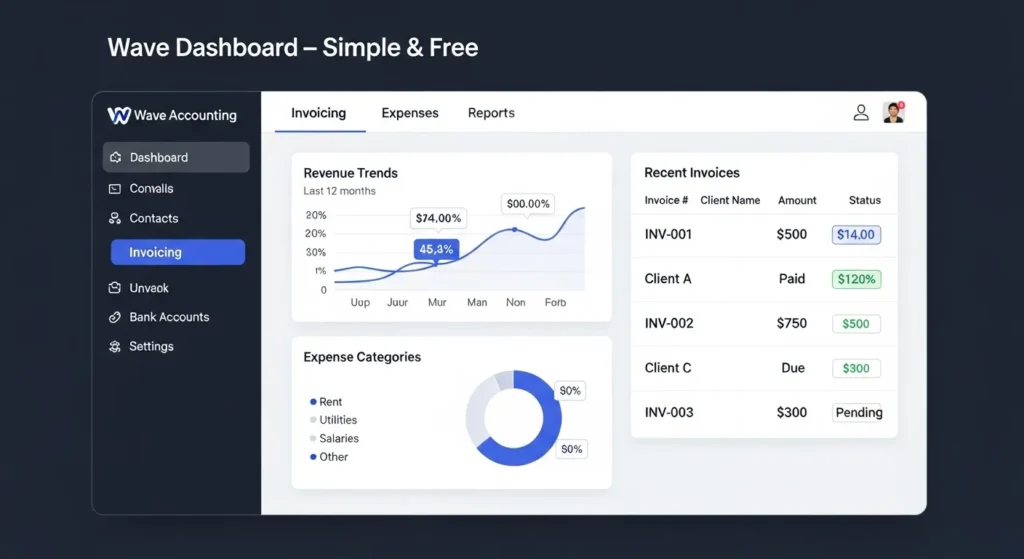

Wave is a powerful free accounting platform designed to make financial management easier for small businesses. This cloud-based solution offers essential features in a user-friendly package that meets the basic needs of freelancers and micro-businesses.

Key Features

Unlimited Income and Expense Tracking

- Bank account connections

- Receipt scanning capabilities

- Credit card sync

- Customizable expense categories

Professional Invoicing Tools

Ultimately, the wave vs quickbooks decision hinges on your business’s specific needs and budget.

- Custom invoice templates

- Recurring billing options

- Automatic payment reminders

- Multi-currency support

Basic Accounting Functions

- Double-entry accounting system

- Journal transactions

- Chart of accounts

- Financial statements generation

Pricing Structure

Wave has a simple pricing model – the core accounting features are completely free. Users can access:

- Accounting software

- Invoicing tools

- Receipt scanning

- Basic financial reporting

There are also additional paid services available:

- Payment processing: 2.9% + $0.30 per credit card transaction

- Bank payments: 1% per transaction

- Payroll services: Starting at $20/month + $6 per employee

Target Audience

Wave is specifically designed for:

- Freelancers who want to manage their invoices easily

- Micro-businesses with basic accounting needs

- Startups with limited budgets

- Small service-based businesses that require simple financial tracking

- Solo entrepreneurs who handle their own bookkeeping

The platform is built with simplicity and accessibility in mind, making it perfect for business owners who need basic financial tools without any complicated accounting knowledge. Its user-friendly interface allows for quick setup and easy navigation, so users can start managing their finances right away.

QuickBooks Accounting Software

QuickBooks is a comprehensive accounting solution designed for businesses seeking robust financial management capabilities. This platform offers a wide range of advanced features that cater to complex business needs.

Advanced Features and Tools:

- Real-time cash flow management with predictive analytics

- Automated bank reconciliation and transaction categorization

- Custom invoice creation with multiple currency support

- Inventory tracking with automatic reorder points

- Project profitability tracking and job costing

- Built-in time tracking for employee hours and billable time

- Automated tax calculations and filing assistance

- Advanced reporting with customizable dashboards

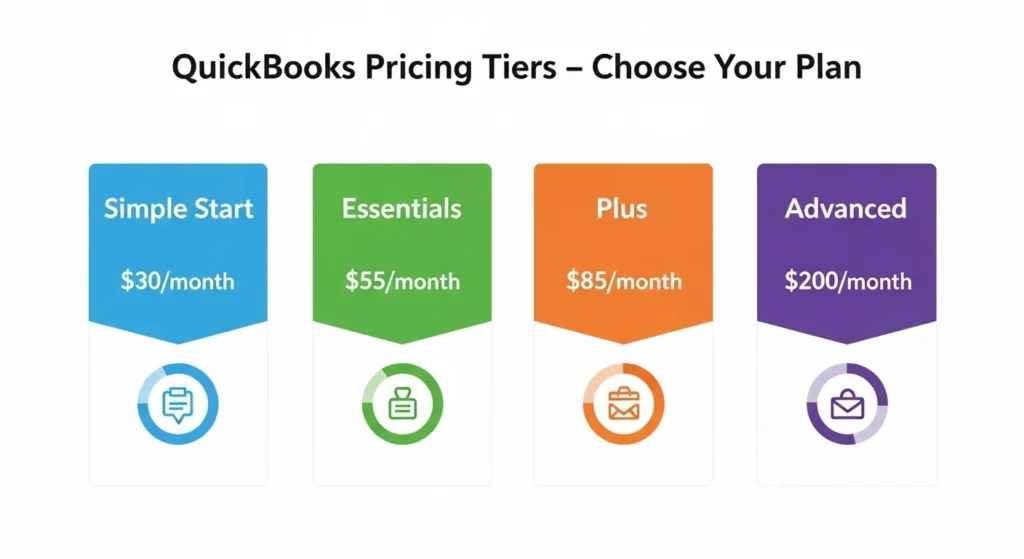

Pricing Structure:

- Simple Start: $30/month – Basic accounting and invoicing

- Essentials: $55/month – Multi-user access and bill management

- Plus: $85/month – Inventory tracking and project profitability

- Advanced: $200/month – Business analytics and workflow automation

Each tier includes progressively more sophisticated features, with custom pricing available for enterprise-level organizations.

Target Audience

QuickBooks caters to established and growing businesses requiring:

- Multi-department financial management

- Complex inventory systems

- Multiple user access levels

- Advanced reporting capabilities

- Scalable accounting solutions

The platform particularly suits:

- Medium-sized businesses with multiple employees

- Fast-growing startups requiring scalable solutions

- Retail operations managing inventory

- Service-based businesses tracking billable hours

- Companies with multiple locations or departments

QuickBooks’ AI-powered features help businesses automate routine tasks, predict cash flow patterns, and generate actionable insights from financial data. The platform integrates seamlessly with popular business tools, enabling streamlined workflows across different business functions.

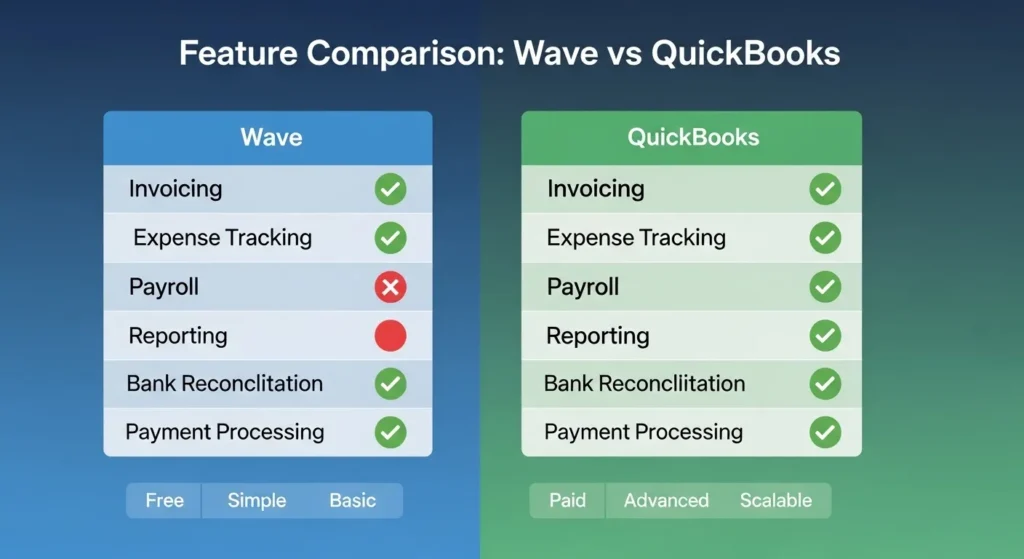

Features Comparison between Wave and QuickBooks

Invoicing Capabilities

Wave’s invoicing system provides customizable templates with basic personalization options. Users can:

- Create recurring invoices

- Send payment reminders

- Accept credit card payments

- Track invoice status

QuickBooks elevates invoicing with:

- Advanced customization options

- Progress invoicing

- Multiple currency support

- Automated late fees

- Mobile invoice creation

- Batch invoicing capabilities

Expense Tracking

Wave offers straightforward expense monitoring:

- Bank account connections

- Receipt scanning

- Basic categorization

- Transaction matching

QuickBooks delivers comprehensive expense management:

- AI-powered receipt capture

- Automatic mileage tracking

- Multiple vendor management

- Purchase order creation

- Advanced categorization rules

- Receipt batch processing

Reporting Options

Wave’s reporting suite includes:

- Cash flow statements

- Profit & loss reports

- Balance sheets

- Tax summaries

- Sales tax reports

QuickBooks expands reporting capabilities with:

- Custom report builder

- Industry-specific reports

- Forecasting tools

- Class tracking

- Location tracking

- Department-specific reporting

- Budget vs. actual comparisons

Payroll Services

Wave Payroll offers:

- Direct deposit

- Employee self-service portal

- Basic tax form preparation

- Standard payroll processing

Note: Wave’s payroll services are available in select countries

QuickBooks Payroll provides:

- Automated tax calculations

- Same-day direct deposit

- Workers’ compensation administration

- Health benefits management

- Time tracking integration

- Auto tax filing

- Multi-state payroll processing

The distinction between these platforms becomes apparent in their feature depth. While Wave maintains essential functionalities suitable for basic business operations, QuickBooks implements sophisticated tools designed for complex business requirements.

The choice between these platforms often depends on specific business needs, growth projections, and operational complexity.

Scalability, Customization, and Integrations in Wave vs QuickBooks

Scalability Options

QuickBooks adapts seamlessly to business growth through tiered pricing plans:

- Simple Start: Basic accounting for new businesses

- Essentials: Multi-user access with time tracking

- Plus: Inventory and project management

- Advanced: Custom user permissions, automated workflows

Wave maintains a single-tier structure:

- Limited to basic accounting features

- No option to upgrade for advanced functionalities

- Restricted to small-scale operations

- Fixed user permissions system

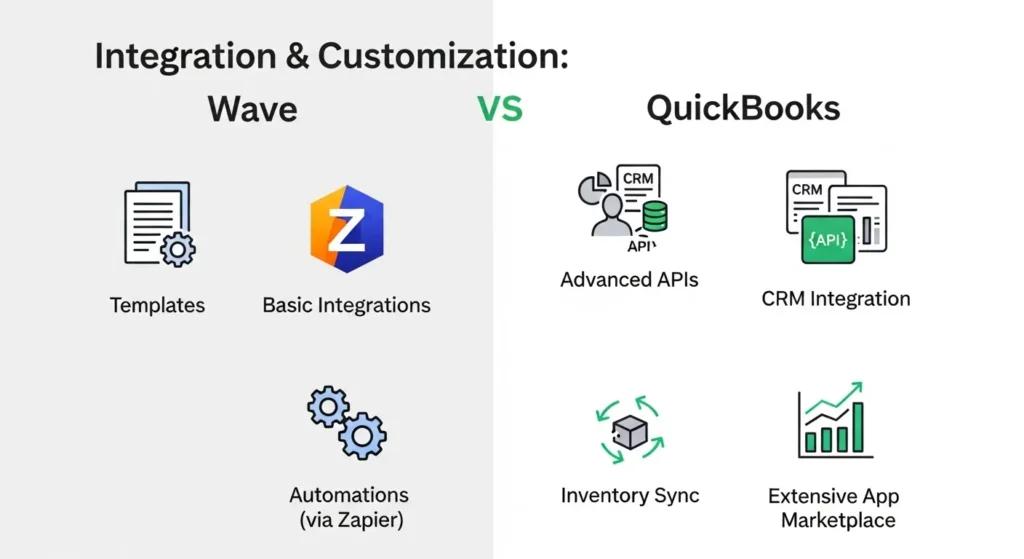

Customization Capabilities

QuickBooks Custom Features:

- Tailored chart of accounts

- Personalized dashboard layouts

- Custom form fields

- Role-based access controls

- Industry-specific report modifications

- Automated workflow rules

Wave Customization Options:

- Basic invoice template editing

- Simple chart of accounts modifications

- Standard dashboard configuration

- Limited report customization

Integration Ecosystem

QuickBooks Integration Network:

- 650+ app integrations

- Native TurboTax connection

- Seamless Shopify sync

- Point-of-sale systems

- Payment gateways

- Banking institutions

- Payroll services

- CRM platforms

Wave Integration Options:

- Limited third-party connections

- Basic Zapier automation

- Payment processing systems

- Bank feed connections

- Payroll service links

The insights from this wave vs quickbooks overview will guide your accounting software choice.

API Access

QuickBooks:

- Public API for developers

- Custom integration development

- Real-time data synchronization

- Webhook support

- Developer documentation

Wave: No public API access

Limited developer tools

Restricted data export options

Basic CSV import/export

Cloud Infrastructure

QuickBooks: Multi-server architecture

Automatic data backups

Load balancing

Enhanced security protocols

The wave vs quickbooks conundrum is something many business owners face when selecting their accounting software.

Data recovery options

Wave: Basic cloud storage

Standard security measures

Limited backup options

Single-server structure

User Experience, Interface Design, and Customer Support in Wave vs QuickBooks

Interface Design

Wave’s interface prioritizes simplicity with a clean, minimalist design. The dashboard presents key financial metrics through visual elements like charts and graphs. Users can access core functions through a straightforward left-side navigation menu, making it easy to switch between invoicing, expenses, and banking sections.

QuickBooks adopts a more comprehensive approach with a feature-rich interface. The platform organizes functions into distinct categories:

- Financial Overview: Customizable dashboard with profit/loss statements

- Banking: Transaction categorization and reconciliation tools

- Sales: Customer management and invoicing options

- Expenses: Receipt capture and vendor payment tracking

Navigation and Learning Curve

Wave’s learning curve spans approximately 1-2 days for basic mastery. New users can:

- Create professional invoices within minutes

- Set up recurring billing without extensive training

- Access basic reports through intuitive menu options

QuickBooks requires 2-4 weeks for users to become proficient. The platform demands:

- Understanding of accounting principles

- Familiarity with advanced reporting tools

- Knowledge of customization options

Customer Support Accessibility

Wave offers:

- Email support for accounting issues

- Live chat during business hours

- Self-help resources through Wave’s knowledge base

QuickBooks provides tiered support:

- 24/7 chat support for all paid plans

- Phone support for higher-tier subscriptions

- Video tutorials and interactive training

- Community forums with active user discussions

Mobile Experience

Wave’s mobile app focuses on essential functions:

- Receipt scanning

- Invoice creation and tracking

- Basic expense management

QuickBooks mobile capabilities include:

- Real-time mileage tracking

- Multi-user access controls

- Inventory management

- Advanced reporting features

The interface design reflects each platform’s core purpose – Wave emphasizes accessibility for basic accounting needs, while QuickBooks delivers comprehensive tools for complex business operations. Support options align with these approaches, offering varied levels of assistance based on user requirements and subscription tiers.

Final Verdict: Which Accounting Software Should You Choose?

The choice between Wave and QuickBooks comes down to your business needs, growth trajectory, and budget constraints.

Wave is the ideal choice if you:

- Run a freelance business or micro-enterprise

- Need basic accounting and invoicing features

- Work with a limited budget

- Value simplicity in your accounting software

- Don’t require advanced reporting or inventory management

QuickBooks stands out for businesses that:

- Plan significant growth or scaling

- Require detailed financial reporting

- Need advanced features like inventory tracking

- Want comprehensive payroll services

- Seek extensive third-party integrations

Your decision should align with your business’s current stage and future aspirations. Wave’s free platform delivers essential accounting tools without complexity – perfect for solo entrepreneurs and small teams. QuickBooks’ robust feature set and scalability make it a strong investment for growing businesses with complex accounting needs.

Consider these factors:

- Monthly budget for accounting software

- Required depth of financial reporting

- Need for inventory management

- Payroll processing requirements

- Growth projections for your business

The right choice creates a foundation for efficient financial management and supports your business goals. Wave serves the essentials, while QuickBooks offers room to expand – select the platform that matches your business trajectory.

FAQs (Frequently Asked Questions)

What are the main differences between Wave and QuickBooks accounting software?

Wave is a free accounting platform primarily designed for freelancers and micro-businesses, offering essential features like invoicing and expense tracking. QuickBooks, on the other hand, is a paid service tailored for medium to large businesses and fast-growing small businesses, providing advanced features, scalability, and extensive customization options.

Which accounting software is more suitable for small businesses or freelancers?

Wave is more suitable for freelancers and micro-businesses due to its free pricing structure and user-friendly interface that covers basic accounting needs such as invoicing, expense tracking, and reporting.

How do Wave and QuickBooks compare in terms of invoicing and expense tracking?

Both Wave and QuickBooks offer robust invoicing capabilities; however, QuickBooks provides more advanced tools for customization and automation. In expense tracking, QuickBooks offers more comprehensive features suited for larger businesses, while Wave covers the fundamental needs ideal for smaller operations.

Can Wave or QuickBooks handle payroll services effectively?

QuickBooks offers integrated payroll services with various tiers to accommodate business size and complexity. Wave also provides payroll services but they are generally more limited compared to QuickBooks, making QuickBooks a better choice for businesses requiring comprehensive payroll management.

What about scalability and integration options between Wave and QuickBooks?

QuickBooks excels in scalability, supporting growing businesses with customizable features and extensive third-party integrations including Zapier and TurboTax. Wave offers some integration capabilities but is less scalable, making it ideal for smaller enterprises with simpler needs.

How do user experience and customer support differ between Wave and QuickBooks?

Wave features a straightforward, user-friendly interface designed for ease of use by freelancers and small business owners. QuickBooks has a more complex interface reflecting its advanced functionalities but provides extensive customer support options suited for medium to large businesses.

When reviewing options, many entrepreneurs find themselves in a debate about wave vs quickbooks for their accounting needs.

It’s essential to reflect on the wave vs quickbooks features to determine what aligns best with your operational goals.

This guide aims to elucidate the wave vs quickbooks differences and help you arrive at the best choice.

When it boils down to it, the wave vs quickbooks discussion is pivotal for small and medium-sized businesses.

The nuances of wave vs quickbooks can significantly influence your experience and efficiency.

For many, the question of wave vs quickbooks is not just about features but also integration potential.

Considering wave vs quickbooks in terms of customer support can also play a vital role in your selection process.

Your selection process will include examining wave vs quickbooks for graphic user interface and usability.

Ultimately, the wave vs quickbooks decision is crucial for effective financial operations.

Thus, understanding the wave vs quickbooks features is integral to maximizing your accounting efficiency.

In short, the wave vs quickbooks comparison sheds light on the best path forward for your financial management.

By understanding wave vs quickbooks, businesses can make more informed decisions.

In conclusion, evaluating wave vs quickbooks is essential for optimizing your financial management approach.

As you explore your options, remember to consider the Wave vs QuickBooks comparison carefully.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.